After graduating law school in 1999, Sarah Davis started a modest eBay store called Fashionphile and noticed her luxury items were reselling close to—and in many cases above—retail prices.

So later that year, she launched Fashionphile as a standalone ecommerce site focusing on the consignment of luxury labels. From Louis Vuitton’s Neverfull Tote to Chanel’s Classic Double Flap, she built an inventory of the most coveted handbags via a direct buyout model and an authentication process.

Davis says the company has been profitable each year ever since, but it wasn’t always very popular. That’s because, Davis explains, for the first decade or so, buying from Fashionphile and other consignment sites was perceived as the ultimate fashion faux pas. “If someone bought a Chanel bag from us and someone complimented them on it, they’d just say ‘Thank you’ and never say it was from Fashionphile,” says Davis.

Eventually the shopping world caught up with the idea of buying pre-owned luxury accessories, whether to save some money or helping save the planet by not buying new. “Because of increased consumer consciousness about sustainability and the circular economy, buying from resale has become a bragging right,” says Davis.

Now Fashionphile has its own reason to brag. Last year, the company pulled in between $450 million and $500 million in gross sales, according to estimates. Davis declined to comment on valuation.

Loading...

Although the first year of lockdown was difficult for her business, Davis says that in 2021 sales rose 107% from the previous year. “The pandemic was a shot in the arm for resale and ecommerce in general,” she says. “The fact that people were sitting around not spending on travel or concerts, they had money.”

There are now larger forces supporting the luxury resale market, which Bain estimated was $33 billion in 2021. Inflation has been rattling the retail market, especially after Louis Vuitton–the largest luxury brand in the world–announced it was raising prices worldwide. Chanel, meanwhile, hiked prices three times over the last two years. And analysts say it’s only a matter of time before rising prices are announced at Gucci, Hermès and other top fashion brands.

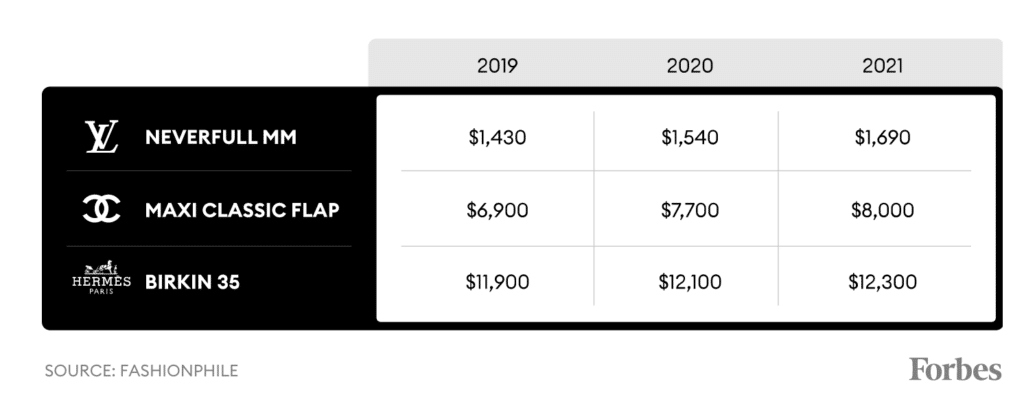

BAG-ONOMICS

The rise and rise of luxury handbag prices.

“Louis Vuitton and Chanel have been raising prices on the same styles since the 1980s. This has been happening every year for decades,” says Davis. But she notes that the percentage and frequency of the hikes have increased in recent years. She adds that inflationary pressures will likely be a boon for luxury resale.

“People are shopping in the pre-owned market with resale in mind. It’s a totally different behavior and something we believe is fueling the increasing appetite for pre-owned ultra-luxury.”

To deal with fluctuations in the retail world, Fashionphile relies on a proprietary pricing tool that uses 20-year historical data, which factors in inflation as well the cadence and the velocity of sales for a particular brand and or item.

But in the luxury economy, data science ultimately takes a back seat to whatever is in style.

“We have to be careful and thoughtful in how we use data,” says Davis. “We don’t know which styles will rise in price to the same degree so we have a team closely watching every style and category. Some styles that were unpopular a few years ago will have a resurgence.”

Inflationary and eco-friendly concerns could also make consignment sites like Fashionphile, Rebag and The RealReal more of a friend than foe to the luxury fashion houses.

“Resale justifies the price increases in the primary market where supply is limited and demand is high,” Davis says. “You can get a new Chanel Flap cheaper from Chanel, the same with Birkins and Kelly. The reality is these hot sellers are standard colors and shapes.”

Supply chain woes are also powering consignment. “For us as a reseller our supply is your closet,” says Davis. The company is “scrambling” for more space to expand for operations and authentications. Fashionphile will be opening a 60,000 square-foot distribution center next month in New York City, adding to its 100,000 square foot facility in New Jersey and 30,000 square-foot operation in Carlsbad, California. Davis says the pandemic proved the value of extra physical space, even for an ecommerce. “Our shelves were getting cleaned. People were buying from us faster than we can get new items through the door… But there were limits to how many people we can get through the building and we couldn’t keep up with the appetite.”

Davis adds, “Part of that was retail therapy, there was no slowdown, even for stilettos.”

By Tanya Klich, Forbes Staff

Loading...