Wall Street billionaires Carl Icahn, Ken Griffin, Israel Englander and Daniel Loeb can thank Elon Musk for what might be 2022’s easiest money trade.

For many hedge funds, Elon Musk’s $44 billion “forced” purchase of Twitter represented an easy money trade.

“You didn’t have to be a genius to realize that he was going to finish that deal,” said Carl Icahn at the Forbes Iconoclast Summit on November 3, adding that he would have considered waging a proxy fight if the deal fell through.

Icahn told the audience at New York’s Historical Society that he made a profit of around $250 million by investing in Twitter this summer. But he was far from the only one to benefit. Regulatory filings show that billionaire-led hedge funds including Citadel Advisors, Millennium Management, D.E. Shaw and Third Point built large positions in Twitter in the second and third quarters, as well as other firms like Pentwater Capital and Farallon Capital.

Musk signed a merger agreement to buy Twitter for $54.20 per share in April, but the stock was trading as low as $32.65 by July when he tried to terminate the deal. That created an arbitrage opportunity for as much as a 66% return for investors who doubted Musk had much of a chance in the Delaware Court of Chancery to back out.

Icahn’s third-quarter 13-F filing with the SEC shows that he owned 12.5 million Twitter shares as of September 30. He said at the Forbes summit he bought in the mid-$30s–if he bought at an average price of $35 per share and made a $19.20 profit on each one when the deal closed at the original price of $54.20 per share on October 28, he would have netted a $240 million profit.

The only fund that made a bigger bet than Icahn was Naples, Florida-based Pentwater Capital Management, founded by Matthew Halbower in 2007. It bought 18.1 million shares during the second quarter and added another 5.3 million shares as of the end of the third quarter. If it bought those 24 million shares at Twitter stock’s median closing price of $40.16 in the first quarter and $41.05 in the second quarter and held them through the completion of the acquisition in October, it would have made $324 million in profit, though its 13-F filing shows it hedged some of those gains by buying put options as well. Pentwater didn’t respond to a request for comment.

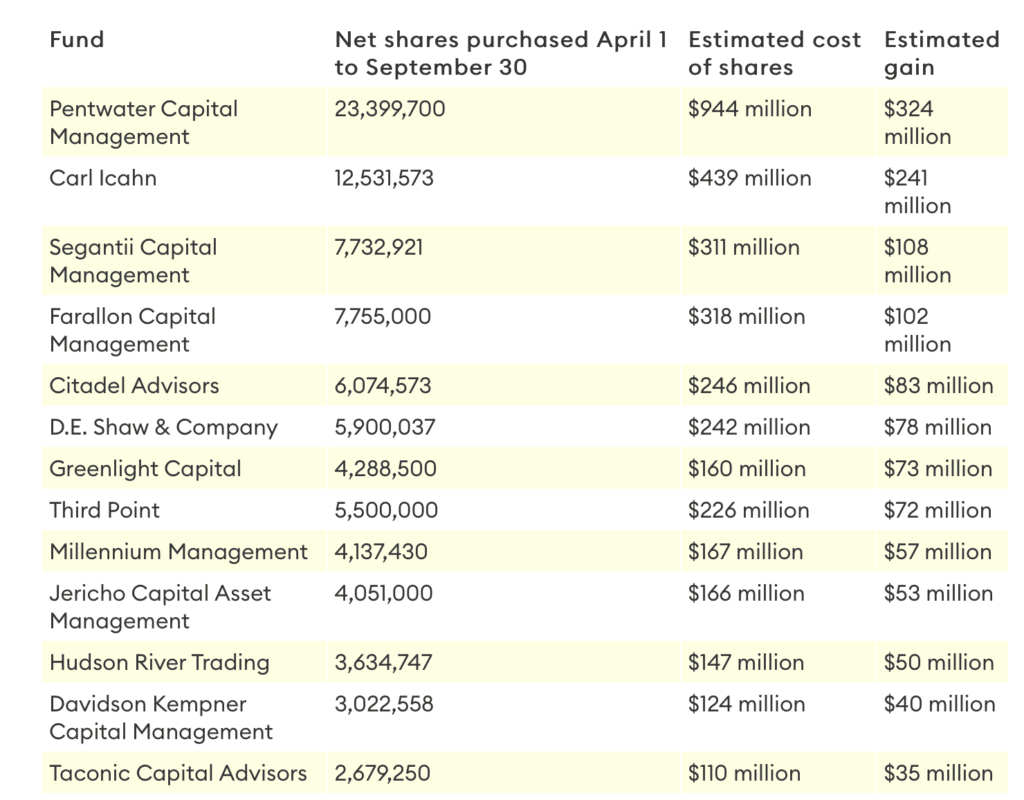

In all, Forbes found 13 hedge funds that spent upwards of $100 million adding to their Twitter stakes between the end of the first quarter and the end of the third quarter this year. We reached out to each fund to ask for average purchase prices, and estimated that they bought at Twitter’s median closing price in each quarter if more precise information wasn’t available. These funds cumulatively purchased more than 10% of the company in the six months leading up to September 30 and likely made well over $1 billion in profits on the deal.

TWITTER WINNERS

These hedge funds added the most to their Twitter positions this spring and summer and likely minted profits if they held on through Elon Musk’s purchase.

These numbers don’t include any additional shares the firms may have purchased in October, when the margins were slimmer while Musk finalized the acquisition, and don’t include possible trading that took place within each quarter. 13-F filings show a simple snapshot of each firm’s long stock holdings on the last day of each quarter and don’t provide enough information to pin down exact gains and losses, but often represent the most thorough picture of what funds are buying and selling.

The biggest winners included Hong Kong-based Segantii Capital Management, founded by British investor Simon Sadler, and Farallon Capital, the San Francisco-based firm founded by Thomas Steyer in 1986 and now run by Andrew Spokes.

David Einhorn’s Greenlight Capital initiated a position of 4.3 million shares in the third quarter, his 13-F filing shows, and he wrote in a letter to investors viewed by Forbes that the average purchase price was $37.24 per share. He expected that the Delaware Court of Chancery would be wary of inviting future buyer’s remorse suits if it let Musk walk away.

“The case law on this is quite clear. If it were anyone other than Musk, we would handicap the odds of the buyer wiggling out of the deal to be much less than 5%,” Einhorn wrote in the letter prior to the completion of the deal. “At this price there is $17 per share of upside if TWTR prevails in court and we believe about $17 per share of downside, if the deal breaks. So, we are getting 50-50 odds on something that should happen 95%+ of the time.”

Musk saw the writing on the wall and reversed course in October, agreeing to pay the full price as these investors expected. His first weeks as Twitter’s owner have been marked by confusion and complaints after he opened verification to anyone willing to pay $8 per month, causing a wave of “verified” parody accounts, and laid off 3,700 employees, almost half of its staff. He has warned Twitter’s staff that “bankruptcy is not out of the question,” but if his $44 billion equity investment goes up in smoke, the hedge funds he paid that cash to will be laughing all the way to the bank.

By Hank Tucker, Forbes Staff