In November last year, Tesla CEO Elon Musk became the first person in history to obtain a $300 billion fortune.

A lot has happened since then. He’s on the verge of buying Twitter after months of back-and-forth and reportedly plans to lay off 75% of its staff if the deal goes through. He had secret twins with one of his employees and was rumored to be having an affair with Nicole Shanahan, the soon-to-be ex-wife of Google cofounder Sergey Brin. (Musk denied the affair.)

He also lost more than $100 billion.

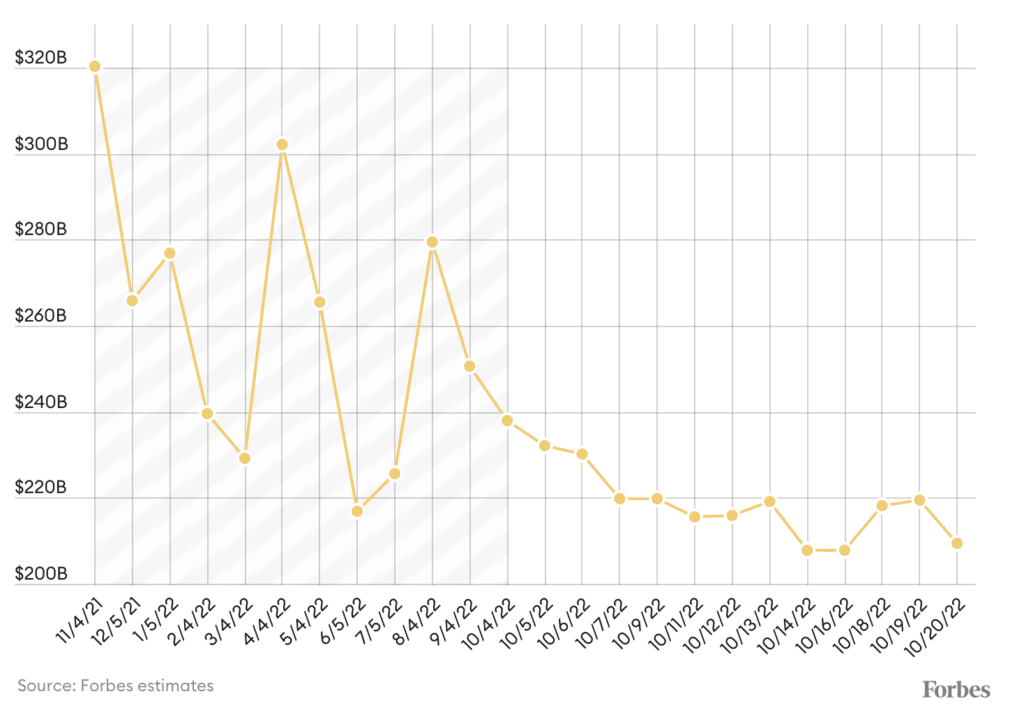

From its peak on November 4, 2021, Musk’s fortune has fallen nearly 35%, from $320.3 billion to $209.4 billion as of close of market Thursday–almost entirely due to a sharp drop in the price of Tesla stock. This month alone, Musk’s fortune is down $28 billion. In quarterly earnings reported on Wednesday, the electric carmaker’s revenue still fell short of some analyst expectations. Add in worries about a possible recession, and investors are spooked.

Farewell To $110 Billion In Eleven And A Half Months: Elon Musk’s Net Worth

“He sells high-priced cars, so a recession will not be good for his business,” says Matt Maley, chief market strategist at Miller Tabak + Co., in an email.

Loading...

Musk was so rich to begin with, he’s still the wealthiest person in the world, even after his fortune took such a dramatic drive. He’s $60 billion richer than LVMH chief Bernard Arnault and $71 billion richer than Amazon founder Jeff Bezos. When he surpassed Bezos last year, he joked in an email to Forbes that he wanted to send Bezos a giant statue with the digit 2.

Musk sold $31 billion worth of Tesla stock in the last year to finance his bid to acquire Twitter and take it private. Since the deal hasn’t been finalized, Forbes counts the value of the cash (minus taxes) gained from those sales toward his net worth. But all of the drama associated with the deal is turning off investors, who believe Musk is overpaying for the social network and is irresponsibly selling Tesla stock to fund it.

“The problem for Tesla investors is that more stock sales are likely by Musk to fund this deal, which we believe will go down as one of the worst, most overpaid M&A deals in the history of the market,” Wedbush analyst Dan Ives said in an email.

Others are more optimistic about Tesla’s prospects. Garrett Nelson, an equity analyst at CFRA Research, says Tesla “remains one of the market’s strongest earnings growth stories over the intermediate and long term” and is encouraged by record vehicle sales in the latest quarter.

By Rachel Sandler, Forbes Staff

Loading...