Purchased for $4 billion, Disney’s superhero factory is now worth more than $50 billion.

For Disney CEO Bob Chapek, this weekend’s debut of Shang-Chi and the Legend of the Ten Rings is a roll of the dice. It’s the first Marvel film to open on the normally anemic Labor Day weekend and its central character, a kung fu master in the mold of ‘70s martial arts icon Bruce Lee, is little-known. Its exclusive theatrical release, which Chapek himself called an “interesting experiment,” comes as Covid cases continue to spike.

The Chinese government has yet to approve the film for distribution in the world’s largest movie market, raising the stakes for Chapek. But Disney has built up quite a bit of wiggle room with its control of the 80-year-old comic-book publisher that writer Stan Lee and illustrator Jack Kirby put on the map: Purchased in 2009 for just $4 billion, Forbes estimates the company is now worth almost $53 billion, or about 16% of Disney’s market value.

Not a bad return on an investment that few said would ever pay off.

“People didn’t fully understand and appreciate the franchise potential of the genre like we did,” says Tom Staggs, Disney’s former chief financial officer who helped lead the acquisition. “We were able to buy it because the industry didn’t totally get it either.”

Loading...

Keeping that value may be one of the biggest challenges facing Chapek, the former theme park and consumer products executive who took over as CEO last year. He has already rankled Hollywood by taking on Scarlet Johansson, one of Marvel’s biggest stars , over compensation tied to the simultaneous theatrical and streaming release of Black Widow, including the contentious decision to disclose her $20 million salary for the role. That strategy also reportedly rankled Marvel Chief Creative Officer Kevin Feige, who didn’t want to see the film downgraded to home streaming.

Shang-Chi presented a different set of challenges for the filmmakers — knocking down problematic Asian stereotypes in the comic that may explain why China has yet to set a release date. The performance of Shang-Chi will influence how Disney distributes the next Marvel installment, Eternals, due out Nov. 5. It may well determine whether the company can adhere to its carefully choreographed schedule of Marvel stories, intended first to debut in theaters, then expanded on TV.

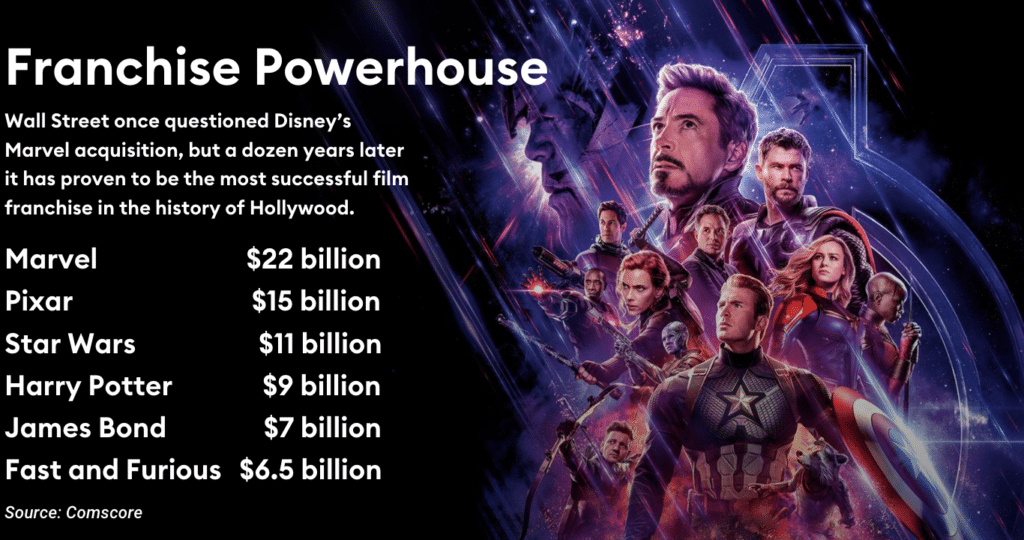

It was that kind of calculated control that turne a lean, independent studio operating above a Mercedes Benz dealership in Beverly Hills into the beating heart of the world’s biggest entertainment company. Twenty-four Marvel titles collectively grossed $21.9 billion in Disney’s hands, making it bigger than Bond, more potent than Potter and massive compared to The Fast And The Furious.

It’s also far better than Star Wars which Disney bought with its $4 billion purchase of Lucasfilm in 2012, delivering box office sales of just $6 billion on the five films it produced. Its $7.4 billion acquisition of Pixar in 2006 also pales, with the 21 Disney-owned films generating ticket sales of $14.4 billion. Marvel, says Comscore media analyst Paul Dergarabedian, is easily the most successful film franchise in history.

Here’s a look at Marvel by the numbers.

FILM — Nearly $6 billion

No. 1 Marvel Film: Avengers: Endgame, $2.8 billion

Marvel superheroes have been a key piece of Walt Disney box office dominance in recent years, giving the studio the two biggest movies of 2018 — Avengers: Infinity War and Black Panther — and one of the highest-grossing films of all time — Avengers: Endgame — a year later. Since 2018, Disney has released seven Marvel films that have collectively brought in more than $9.4 billion, according to data from Comscore. That kind of dominance boosts the value of all its other films by driving up the price the company can get from cable TV networks like Starz or streaming services like Netflix to show them. Media analyst Richard Greenfield estimated the value of Disney’s 2012 Netflix deal, which provided the streamer with access to newly released films starting in 2016, would generate $450 million in revenue in its first year.

STREAMING — $40 billion+

Most-Watched Marvel Show: Loki

WandaVision. The Falcon and the Winter Soldier. Loki. Marvel shows have helped attract 12.4 million new subscribers to the Disney+ streaming service from April through June, bringing the total to 116 million as of July. The WandaVision debut was a Top 10 hit and which only got bigger with each one of its nine episodes — Nielsen estimates it was viewed by 30.5 million people. The Falcon and the Winter Soldier captured an audience of 28.3 million, Nielsen reported, while Loki, which debuted three months later, drew an even larger 35 million viewers, according to the measurement service. No surprise, ten more Marvel series are coming, including Ms. Marvel, the first Muslim-American superhero; Hawkeye, with actor Jeremy Renner reprising his Avengers’ expert marksman character; and She-Hulk, played by Emmy Award-winning Tatiana Maslany. “The addition of the Marvel content … is a tremendous catalyst of growth for us,” Chapek told investors in May, noting it built on the success of the Star Wars-inspired original series, The Mandalorian. Marvel’s Black Widow exceeded $125 million in sales on Disney+, where it premiered on the same day as the film’s theatrical release, sparking a high-profile battle with star Scarlett Johansson over profits that could well set a precedent for how talent is compensated in the streaming era.

CONSUMER PRODUCTS — About $3 billion

No. 1 Selling Marvel Product: Super Heroes Avengers Iron Man Hall of Armor, $45 price

Under Disney, sales of all things Marvel — Spider-Man swim trunks, Hulk bedding, Winter Soldier and Captain America action figures — account for nearly $10 billion in licensing revenue from merchandise sales since 2010, according to Forbes calculations. Marvel Chairman Ike Perlmutter initially viewed toy sales as the profit driver for the company, with the films playing the role of marketing. Today it is making heaps of cash on both. Disney does not disclose what percentage of revenue is attributable to Marvel, though two people with direct knowledge say it’s second only to Disney’s classic characters (Mickey, Minnie, Donald, Goofy) in revenue.

THEME PARKS — TBD

First Marvel Attraction: Iron Man Experience, Hong Kong Disneyland

Despite being in Disney hands for more than a decade, it’s still too early to estimate its value to the enterprise — but its six-acre Avengers Campus opened at Disneyland in June and is already drawing crowds who show up to interact with characters such as Iron Man, Thor, Captain Marvel or Black Panther. One attraction, the Spider-Man Web Slingers ride, sends guests on a 3D mission to combat an infestation of Spider-Bots at the Headquarters, not far from the 2017 remake of the Twilight Zone-inspired Tower of Terror plunge that is now branded the Guardians of the Galaxy – Mission: Breakout dark ride. “They’ve done it right,” said Dennis Speigel, chief executive of International Theme Park Services consultancy. “There have been huge crowds and waits to get in.” Marvel is making its way around the world. An Ant-Man and The Wasp attraction opened in 2019 in Hong Kong Disneyland. Coming soon: Epcot Center’s Guardians of the Galaxy: Cosmic Rewind indoor roller coaster and an Avengers Campus concept at Disneyland Paris.

METHODOLOGY Disney doesn’t disclose Marvel’s value and analysts who cover the company haven’t done so independently, so to estimate its current value Forbes consulted with former company insiders, industry observers and Wall Street analysts. We used operating income for the film and consumer products units and estimated Marvel’s contribution at 22% — its share of the company’s total box office for the past decade. A 15x multiple was applied. Disney+ was included at the $200 billion valuation assigned by MoffettNathanson’s Michael Nathanson.

By Dawn Chmielewski, Forbes Staff

Loading...