TOPLINE

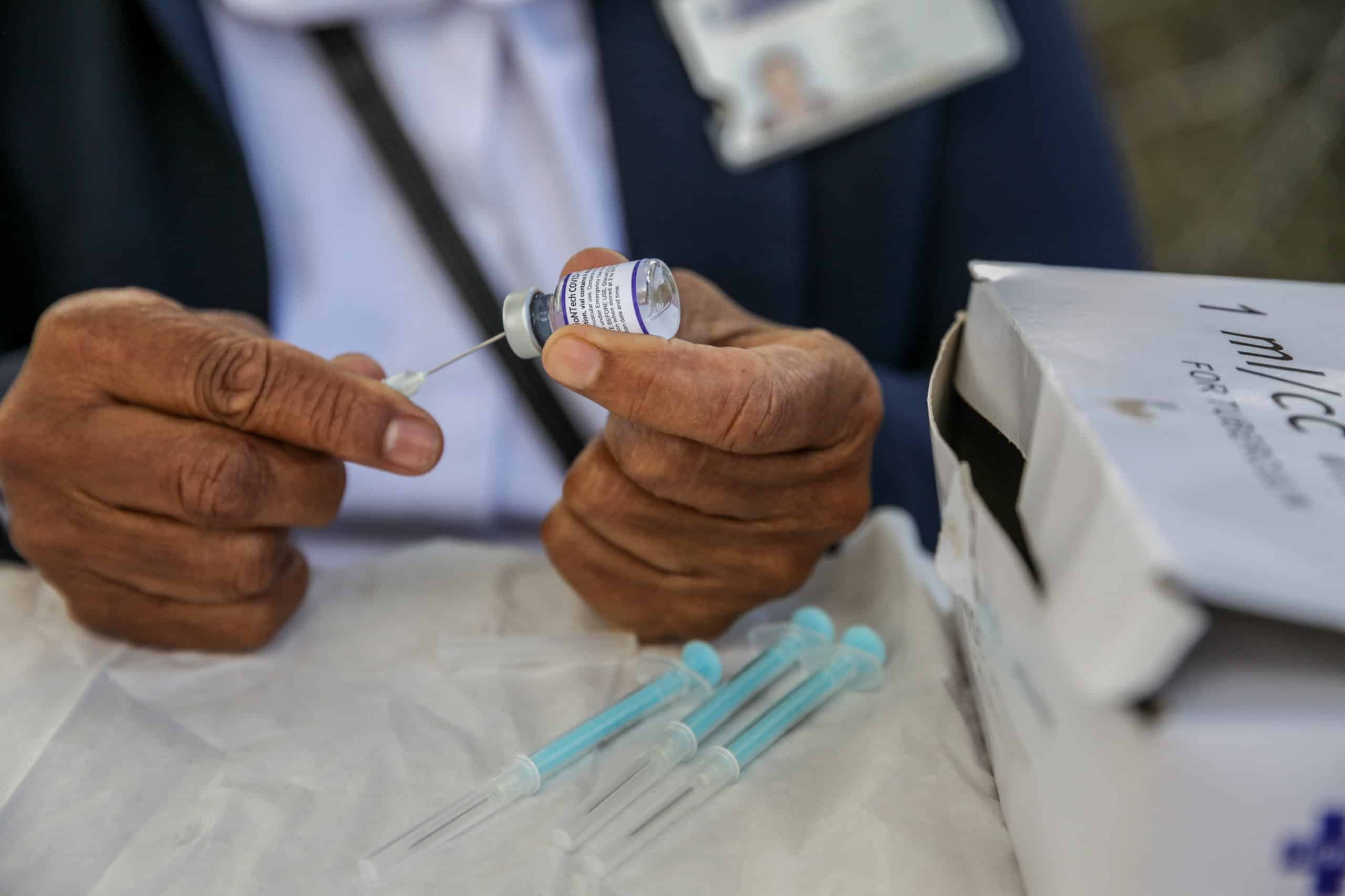

Pfizer shares tumbled again Monday, continuing the pharmaceutical giant’s struggles tied to declining demand for its Covid-19 products and essentially wiping out the entirety of the firm’s peak pandemic gains.

KEY FACTS

Pfizer stock slipped 1.6% to $28.96, closing at its lowest share price since March 26, 2020.

After notching record overall revenue and profits in 2022, Pfizer’s luck has run out so far in 2023, reporting a 42% decline through the year’s first nine months and reporting its first quarterly loss since 2019 in its October 31 earnings report.

BIG NUMBER

$170 billion. That’s how much market capitalization Pfizer has lost since December 2021.

KEY BACKGROUND

Including dividends, Pfizer has posted a -40% return on investment this year, the 15th-steepest loss of any S&P 500 company. Other pharmaceutical stocks which soared during early development and adoption of Covid treatments have also flailed, including Moderna (down about 80% from its 2021 peak), BioNTech (down about 70% from 2021 peak) and Johnson & Johnson (down nearly 20% from 2021 high). Pfizer’s recent plunge came after the company slashed sales guidance for October 16, with sales for its vaccine down 70% year-over-year and Paxlovid revenues down 95%. Pfizer “finally threw in the towel on the potential for reinvigorated” demand for its two primary Covid products, UBS analyst Colin Bristow wrote in a note to clients last month.

Loading...

CONTRA

It’s not all doom and gloom for pharmaceutical stocks, though the balance of power has shifted. Drug makers Eli Lilly and Novo Nordisk have both climbed more than 70% over the last 12 months as their respective weight loss medications surge in popularity, and the two are now the most valuable pharmaceutical companies in the world by market cap. Pfizer, which was more valuable than both Eli Lilly and Novo Nordisk at the end of 2021, is now worth less than half of each firm.

Loading...