Despite the economic outlook in the region, the high-net-worth segment has been growing over the last decade, reaching a crescendo with the recent entrance of new foreign private banks and wealth management services into the regional market. FORBES AFRICA takes a look at these movements on how the wealthy and ultra-rich in East Africa are changing the way they manage their assets.

BY MARIE SHABAYA

OVER THE LAST decade, five East African nations have seen a net-positive growth in total wealth, according to figures from New World Wealth. Leading the pack are Rwanda (60%), Ethiopia (52%) and Uganda (50%). Delving deeper into this picture, Kenya, a growing economic hub for the region, has the highest per capita wealth in East Africa, and ranks eighth on the continent, at $1,700.

This makes a strong case for the new financial services now available to high-networth individuals (HNWIs) in the region. In fact, East Africa is now a growing market for wealth management services and experts. This is echoed by the changing trends in how this segment has been holding their wealth.

Traditionally, investment options for the wealthy and ultra-rich were concentrated predominantly in land, real estate (property and buildings) as well as cash. Over the last few years, there has been a marked shift with this capital being held in sovereign bonds or fixed income securities.

Why the shift? Charles Mwaniki, a business journalist who has been covering the regional financial markets for over a decade, notes that what we’re seeing now is the result of movements from the past decade, whose effects are now being compounded.

“The big shift I’ve seen is the move towards the professional management of wealth.

Previously a lot of [wealthy] people were having to manage their own wealth in private family offices or as private individuals but over the last seven years, we were coming out of a period of plenty, between 2004 and 2015, when there was ample opportunity to make money,” he says.

The overall economic climate during this time was one of a financial boom, allowing for the expansion of

the HNWI segment in the region

“It was a two-fold thing. One, it introduced a lot of new money into the economy and a lot of people got wealthy or got money that was investible within that period. Secondly, the people who already had money were making it more easily. It was easy to multiply wealth. So, you didn’t need much help to make money; there were opportunities everywhere…in trade, in the stock market, in bonds. But, from around 2014-15, it suddenly became a lot more difficult to make money here.”

What followed was an extended period of decline in both the stock market and the banking sector. Beginning in 2016, banks restricted their lending to the private sector due to a legislative cap on commercial lending rates.

“Trade also became more difficult. People started realizing [that they] needed help to unlock opportunities, to see where the money is and that is where they increasingly turned to professionals, especially those who had made new money in the decade before. Suddenly, there were no opportunities in the stock market, they didn’t know how to invest offshore, they didn’t know how to play the property sector so they turned to professionals,” posits Mwaniki.

This has seen a rise in dedicated wealth management units in some of the more established banks and lenders in the region, with new entrants joining the market as recently as this year. Stanbic Bank Kenya, formerly known as CfC Stanbic, is one of the larger service providers in the region, providing a private bank offering to both individuals and corporate clients with at least $1 million in investible assets. New entrant, Old Mutual, from South Africa, opened its doors to highnet-worth clients with at least KES 10 million ($83,130) in investible assets in July this year while I&M Capital, a fund manager, launched in mid-2021 and famously raised $5.8 million in its first six months, indicating the growing demand for such services in the region.

“ PUTTING IT SIMPLY, MOVING CAPITAL

OUTSIDE OF AFRICA CAN OFTEN MEAN

DIRECT ACCESS TO CHEAPER DEBT

FINANCING AND A GREATER ARRAY OF

PERSONAL AND FINANCIAL SERVICES

TO INVEST BACK INTO THE REGION OR CONTINENT. ” – JON DE JAGER, MANAGING DIRECTOR OF C|T GROUP UK

A majority of wealth in the region is family-led and organized by kin either in business structures or by ownership. This allows for wealth management efforts to be compounded over the generations, a model which has worked well in other markets. Tsitsi Mutendi, who consults for private family offices in the region draws a line between the services offered by the new private banks and the niche services required for those over a certain wealth threshold.

“A family office is particularly created for ultra high-net-worth individuals and families. It makes sense to open a single family office, dedicated to one family and the management of its wealth and investments. It’s usually families that are worth a $100 million or more that can afford a single family office. Where you start off with your ‘Mom & Pops’ store growing to bigger business, you can still have an accountant managing finances or a private bank managing income. When it gets to $100 million and above, in terms of net worth, a dedicated office has a better overview of what the asset holding looks like, what the available wealth in terms of finances looks like and what investments are being made. Family offices tend to hire investment managers as investments at this level tend to be larger.”

According to this year’s Africa Wealth Report, Nairobi is one of Africa’s wealthiest cities, anchoring the region with $48 billion in total private wealth with an estimated 5,400 HNWIs. Those over the $100 million net worth bracket, however, only number 12 with a healthy crop of multi-millionaires (net worth of over $10 million) at 260 individuals. Mombasa, Kenya’s coastal second city, plays host to 800 HNWIs with a combined wealth of $7 billion. Dar-es-Salaam, the Tanzanian capital and home to Africa’s preeminent billionaire, Mo Dewji, has the region’s second-largest HNWI community with 1,300 individuals holding a total of $24 billion in private wealth. The Ugandan capital, Kampala, which has seen marked growth in total wealth over the last decade is home to 900 HNWIs worth a cumulative $16 billion.

Many of these developments are being led by family wealth either through burgeoning businesses or the expansion of pre-existing wealth. Mutendi contends that this may be due to new perspectives on wealth building.

“We have a melting pot of different family businesses and different drivers to wealth [that is] being built. The movement of the world as well as the different generations and how [they] perceive wealth, manage wealth and [their] history within the wealth pocket [is a contributor]. The nouveau riche is usually centered on one demographic but it is one that is coming into wealth after many years of being disadvantaged with financial status. With funds moving out of the continent, you have different push and pull factors.”

These factors are the back-end of much of the wealth growth that we’re observing in the region.

According to the 2022 Africa Wealth Report, investment migration is fast becoming a popular option for the continent’s affluent families. In fact, it’s a proven wealth management and legacy planning tool with 19 of the G20 countries already implementing policies that encourage inward investment in exchange for citizenship or residence rights. Henley & Partners, a London-based investment migration consultancy who authored the report, noted that they saw an 18% rise in inquiries about these programs from African clients in 2021.

Jon de Jager, Managing Director of C|T Group UK, an advisory firm working with African HNWIs, explains that the movement of capital goes beyond wealth migration and has been a prominent trend.

“There has been a trend of East Africa capital being consolidated outside of the continent although, equally, there has been significantly more wealth generated within the region. Jurisdictions outside Africa have historically been a more attractive base from which

HNWIs can invest internationally across developed economy capital markets. Putting it simply, moving capital outside of Africa can often mean direct access to cheaper debt financing and a greater array of personal and financial services to invest back into the region or continent,” he says.

However, access to these foreign financial markets isn’t always guaranteed for African investors. Enhanced due diligence checks, Know-Your-Customer (KYC) standards among other regulations often bar HNWIs from the continent from transitioning to some of these offshore locations. Whilst this has happened in the past, now it is more difficult to achieve due to regulatory requirements.

“There is often a fundamental lack of understanding of the East African region, and of Africa as a whole. HNWIs originating from the continent of Africa are often classified in the same bucket and lazy assumptions can be made as to their source of wealth or political connections, for example. We have worked very hard the last few years in establishing a credible and detailed fact pattern for individuals looking to move their capital into different markets. It is often assumed that documents are lacking

for the region to meet enhanced KYC requirements, but that is not the case. What many African HNWIs need is an opportunity to explain, transparently, the facts behind their background and business history,” notes de Jager.

Scrutiny aside, HNWI capital from the region is still finding its way to more stable settings, offshore.

“Dubai in particular has recently become a popular destination on a global basis, not just from Africa. This has partly been for protection; while Kenya has no doubt become a major economic hub, and I believe will gain further momentum as such, there has been some political instability that can trigger capital flight.

Another market that we see movement to is Singapore. It is perceived by many as a stable and fast-growing economy in Asia and we are seeing this trend not just from businesses in East Africa. Singapore does offer tax advantages to offshore non-resident companies and as a result is becoming the gateway to Asia’s banking and investment markets,” notes de Jager.

However, capital flight is not the only trend we’re seeing within this segment. A movement towards reinvestment in the region, and continent, may be due to a rise in locally-based wealth management services and offerings. While growth of this market has been slow, it does signal hope for HWNIs looking to consolidate their wealth within African economies.

“There is still domination from foreign entities or agents and representatives of larger institutions that have come to the continent that are encouraging family businesses or offices to invest offshore. At the same time, our wealth advisory industry is growing at a snail’s pace. Our institutions are opening up more to setting up family office offerings and private wealth offerings over and above private banking.

It’s the right start, over the past five years there has been a move towards more customised offerings and collaborations with institutions that can offer their clientele prestige banking that goes over and above what is available on the continent,” explains Tsitsi Mutendi who has been working in various African wealth markets.

Jon de Jager, agrees, noting that while offshore markets offer a buffer from prevailing instabilities in African economies, HNWIs from the region are seeking to return their capital to their home jurisdictions as long as conditions permit.

“There is an appetite as well as a continual desire to reinvest in Kenya, East Africa and generally across the continent. Especially now, due to the global demand of natural resources, we have seen a significant drive to reinvest in Africa. At the same time, it is noteworthy that six African start-ups were listed among the World Economic Forum’s Technology Pioneers of 2022. Just as we have seen with M-Pesa, these start-ups are solution-driven and are leading the way in solving issues such cyber security, climate change and food security. In this context, I am positive that this will attract investment in Africa.”

What is important for the region’s wealthy demographic is choice. Given the myriad push and pull factors at play on the continent from economic to political instability, HNWIs often seek options that safeguard their hardwon multigenerational wealth or new avenues that enable them to build newly acquired money.

This is true for all investors, African or otherwise, so flight to economic safe havens is a natural

strategy for this segment.

“It is natural for a successful entrepreneur to expand their horizons on an international stage by adding other geographies to their investments, in or outside of Africa, just as it is for a HNWI from Europe, for example, to invest in Africa. Establishing a presence outside of the continent for this purpose is necessary and efficient. Restrictive policy interventions are unlikely to facilitate growth within the region while persistent allegations of corruption or kleptocratic behaviours will always put off investors. Social factors, like high rates of crime, also come into play; issues like this simply add to reasons to move elsewhere in search of returns. Innovation is certainly attractive in terms of investing in Africa, but these must be supported by good governance and strong rule of law in establishing a stable environment in which to operate,” insists de Jager.

“ THE NOUVEAU RICHE IS USUALLY CENTERED

ON ONE DEMOGRAPHIC BUT IT IS ONE THAT

IS COMING INTO WEALTH AFTER MANY YEARS

OF BEING DISADVANTAGED WITH FINANCIAL

STATUS. WITH FUNDS MOVING OUT OF THE

CONTINENT, YOU HAVE DIFFERENT PUSH AND

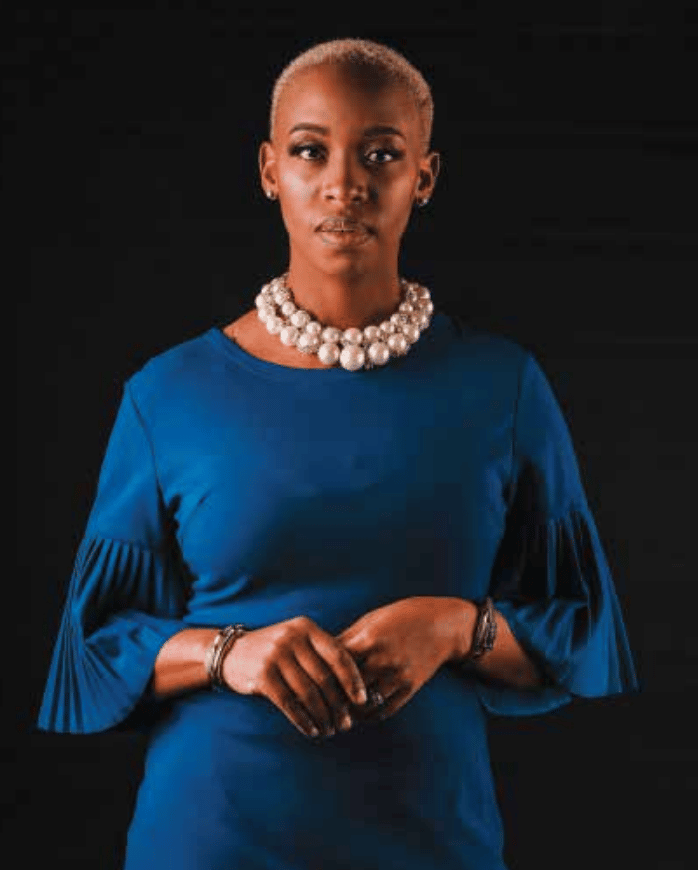

PULL FACTORS. ” – TSITSI MUTENDI

Already, estimates indicate that wealth on the African continent is set to increase by 38% in the coming decade and this may be due to factors already at work within the continent’s markets. A key point, to capture this growth for the long-term, is ensuring that younger generations are equipped to take over the management of wealth sooner rather than later. According to Mutendi, at the family office or business level, this means having strong family governance structures that are flexible enough to incorporate the incoming generation, and their ideas, as they build.

“Africa’s got so much potential, there is still a vast amount of wealth that is coming from the continent and is going outside of the continent. So, there is so much possibility for families building wealth. They just have to continue cultivating innovation, especially the next generation…they are the ones that will build on the wealth that is currently being created,” she says. This is particularly important for East African families, says Mwaniki who has picked up on new patterns through his observation of the regional financial markets, noting that the younger generations are the ones leading the charge in new investment trends. “These are fairly young, wealthy people. Some of [their wealth] has been here but has been held by their parents. Once they inherit land they dispose of it because they don’t see themselves managing a farm, for example. So they invest in NFTs (Non-Fungible Tokens), cryptocurrencies or bonds. They are looking for options that will generate regular and high returns. Land you can hold but if you don’t have another source of income, it’s an idle asset. They are turning more and more to incomebearing instruments,” he says. When all is said and done, wealth creation remains a positive development across the continent. Kenya, the regional leader in continental rankings, is one of the ‘Big 5’ markets that account for more than half of total wealth in Africa.

The steady growth of HNWIs here will undoubtedly signal expansion in neighboring jurisdictions, encouraging more robust regulations and stable economic environments for their capital;

wealth migration, notwithstanding, remains a mitigating factor.