SAM DARWISH HAS CHOSEN EMERGING MARKETS AS THE UNIVERSE IN WHICH TO GROW AND CONNECT. READ ON ABOUT THE TOWERING AMBITIONS OF THIS ENTREPRENEUR WHO ROSE AS AN ENGINEER TO RUN ONE OF THE WORLD’S LARGEST PROVIDERS OF TELECOMS INFRASTRUCTURE, RECENTLY LISTED ON THE NEW YORK STOCK EXCHANGE.

We went through a lot of hardship, but what that period gave me was a lot of focus and determination. I became an avid reader, thanks to my father’s modest bookshelf, and I used to read his books regularly with a passion. There was nothing to do because you could not go out and play in the streets. The easiest thing for me, which was the most valuable thing for a kid to do, was to read.

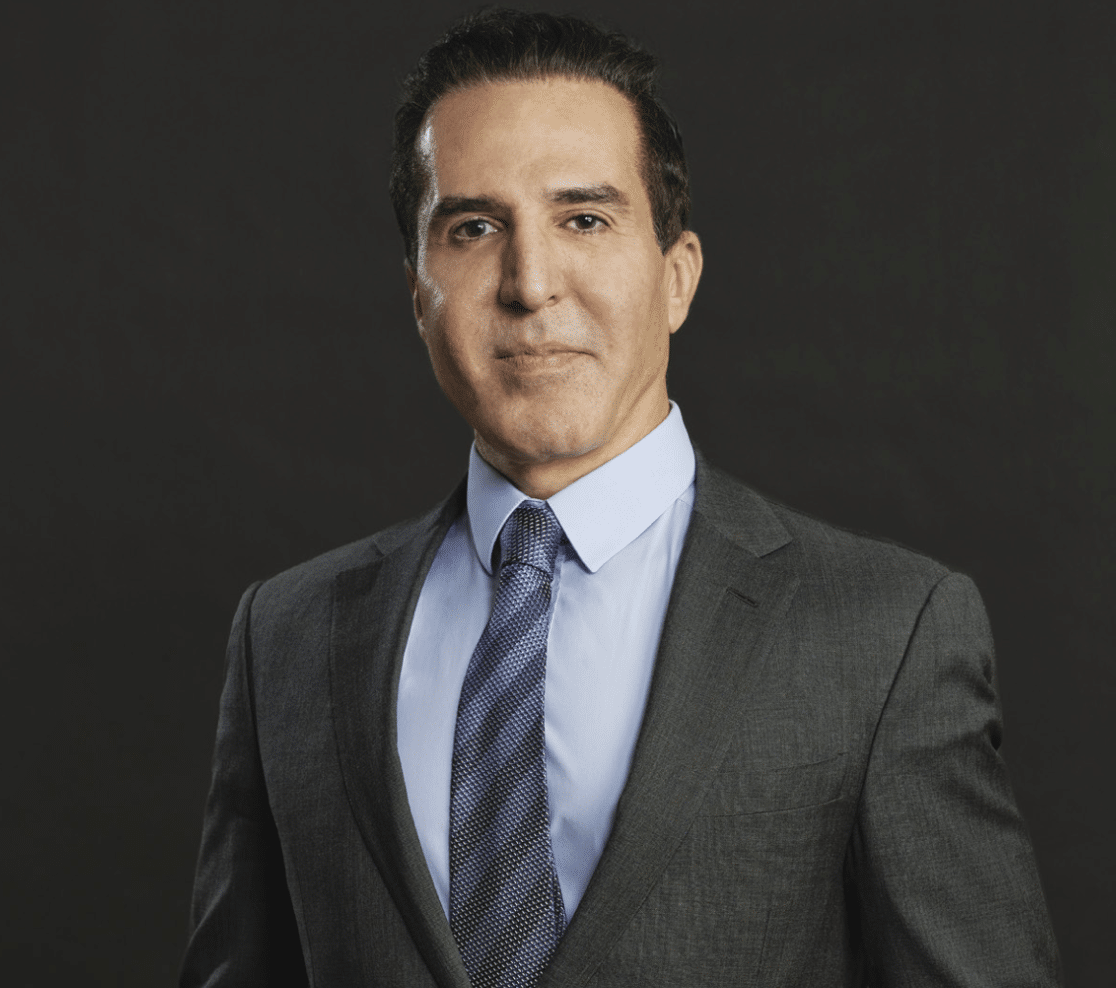

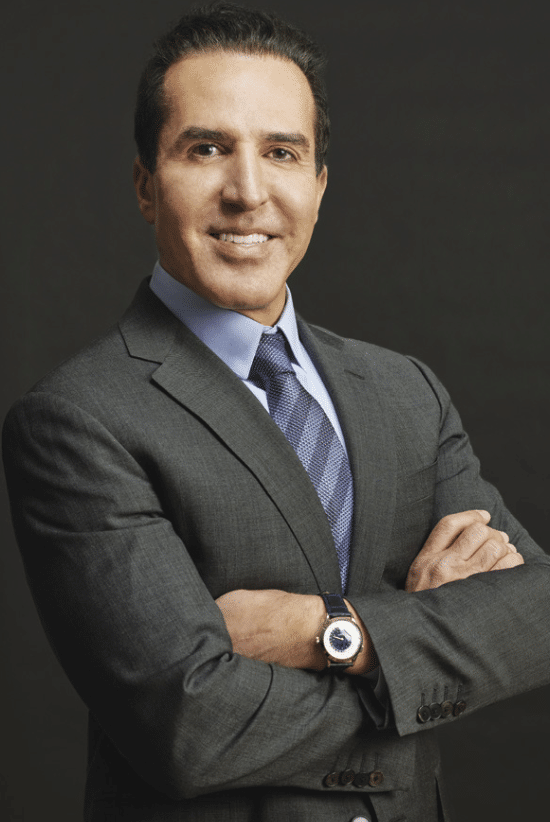

SAM DARWISH is no stranger to adversity. He spent his early childhood trying to survive the hardships brought on by the brutal civil war that gripped the West Asian country of Lebanon that he called home. Today, he is Chairman and CEO of IHS Towers, the largest telecommunications infrastructure company in Africa and one of the very few with global operations and aspirations.

With a current valuation of $7 billion, as per the company’s Q3 results last year, IHS Towers is one of only a handful of unicorns in Africa.

In October last year, Darwish marked another milestone by listing IHS Towers on the New York Stock Exchange (NYSE), a lifelong dream for the telecom entrepreneur, and a move you don’t often hear about in Africa.

Loading...

“When I rang the NYSE bell on October 14 2021, it was a privilege. I don’t think anyone of similar background or path has done this before. We are talking about ringing the opening bell of the NYSE, the largest stock exchange on earth and the pulsating heart of the global capital markets,” exudes Darwish when we meet him for this recent interview via Zoom.

From Lebanon to Lagos, he is beaming with pride in his business suit, but in scaling to those heights, taller than his towers, he has had to face some pretty low moments.

The trauma he faced in his early years seem like a lifetime ago for him now. Growing up during those bleak war-torn times in Beirut, Lebanon, Darwish had to find ways to not just survive but make meaningful sense of his long days.

“When you are a kid, you don’t realize that everyone around you is dying but over time you realize the adversity of the situation; when electricity is cut for days, when you see your father taking the battery out of the car and bringing it to the house so that he can light a bulb or turn on a small TV; you start to realize that things are not normal,” recalls Darwish of those dark times.

This difficult childhood helped embed two important traits in Darwish – the thirst for knowledge and the value of perseverance.

“We went through a lot of hardship, but what that period gave me was a lot of focus and determination. I became an avid reader, thanks to my father’s modest bookshelf, and I used to read his books regularly with a passion. There was nothing to do because you could not go out and play in the streets. The easiest thing for me, which was the most valuable thing for a kid to do, was to read.”

After receiving a Bachelor of Engineering degree – with distinction – in 1992, he joined MCI, a telecom carrier, as a satellite systems manager and over the following years became one of a small number of cell phone engineers in Lebanon.

We are the undisputed leader of telecom infrastructure in Africa. Our plan, however, is global. Excluding China and India, there are over three billion people in the emerging markets with less than a handful of infracos with a global emerging market focus.

A chance encounter with a group of Lebanese entrepreneurs who had acquired a Global System for Mobile Communications (GSM) license, brought Darwish to Nigeria.

“I helped set up the mobile phone network in Lebanon in the 1990s with Telecom Finland, and thought that coming to Nigeria would just be a two-year period to help set up another GSM network before continuing on to the United States.

Photos by Maike Schulz/Gruber Photographers

“Emigrating to the US had been my dream since I was young. I saw the US as the land of opportunity, the land where a person is respected as an individual with liberties guaranteed by its Constitution. In my opinion, this is the fundamental thing that defines America which is also why I’m delighted to have become a citizen,” says Darwish.

That two-year layover in Nigeria turned into 23 years.

During that time, Darwish set up IHS Towers, when the former Nigerian President Olusegun Obasanjo privatized the telecoms industry and issued licenses to telecom companies.

“I came from a country of four million people to Nigeria, a country of 150 million people. I felt like Alice in Wonderland given the size and the scale of the country. Yet despite the large population, there were barely any telephones in the country. I think at the time there were about 8,000 mobile phones and only a few hundred thousand fixed telephone lines,” says Darwish.

Nigeria is where he was able to put to test his perseverance and tenacity, traits acquired from his childhood.

“I think it’s important to persevere. Everyone has goals, dreams and aspirations. The difference between people who make it and those who don’t comes down to perseverance. You may fail once, twice or many times but you keep pushing until you make it. Along the way you may stop, reassess and potentially chart a new path to get to your goals. But one thing is for sure, never stop trying.”

No one believed the potential of the mobile telephony market given the high cost of service in the initial years. However, Darwish believed there was a way to reduce communication costs and make mobile phones accessible to anyone who wanted to get connected.

So, in 2001, he set up IHS Towers and started building towers for Africa’s mobile network operators (MNOs).

One of his first clients was Motorola who chose IHS Towers to provide all services related to building and running their towers.

A decade in, and there was more to report.

By 2010, IHS had shifted its focus towards the ownership model.

“We asked ourselves, ‘why don’t we own the towers ourselves and lease them to carriers’? Up until then, MTN, Orange and Vodafone all built their own towers. With each tower, these MNOs had to spend scarce resources on building their own towers, paying rent to landlords and setting up their own power supply; a very inefficient operating model. When we build a tower, we lease space for wireless antenna to several MNOs on the same tower. The infrastructure-sharing saves expenses for MNOs and also allows them to focus on their core business,” notes Darwish.

By 2012, the company had raised its first $79 million equity funding led by the International Finance Corporation.

In 2014, Darwish told FORBES AFRICA he was looking to raise $1 billion for his tower infrastructure business. Today, that investment stands at multiple billions of dollars, representing over 35,000 towers under management in 11 countries across Africa, Latin America and the Middle East.

Along the way, his personal networth has also grown in excess of $500 million, his team confirm. (In the 2014 story on him in FORBES AFRICA, his wealth was cited as $200 million as valued by the Forbes wealth unit in the US.)

“We cover 750 million consumers globally – we either already operate or soon will operate in some of the largest emerging market countries – Nigeria, Brazil, Egypt and South Africa. We are the undisputed leader of telecom infrastructure in Africa. Our plan, however, is global. Excluding China and India, there are over three billion people in the emerging markets with less than a handful of infracos with a global emerging market focus.

“So much potential to grow! The average age in the emerging markets is 20 compared to 40 in the US or 45 in Europe. This is the future, and the universe in which we will grow. For example, there

is no reason why IHS cannot be in 30 markets over time. We are the only company with African origins that has come from Nigeria, to list on the NYSE with approximately 35,000 towers pro forma including our MTN South Africa acquisition. This makes us uniquely skilled to tackle the global emerging markets challenges and succeed,” says Darwish.

One of the key reasons for listing on the NYSE, as opposed to an African stock exchange, was to help combat negative stereotypes about Nigerian-origin companies.

As Darwish puts it, this is an issue of governance.

“Investors want to know that you adhere to the best corporate governance practices and that you are a sustainable business. In my opinion, Africa suffers not from a lack of opportunities but from a perceived lack of governance. Investors expect a very high level of governance practices in terms of sustainability, gender equality, and ESG such as whistle-blowing, code of conduct… and companies need to have zero tolerance towards unethical behavior as part of their DNA to be able to attract capital to scale and grow,” Darwish says.

By coming to New York, Darwish is telling the world that this is the level of governance IHS Towers adheres to. “After all, the NYSE and SEC (Securities and Exchange Commission) must approve your listing, banks must authorize it, you have the New York State and the Department of Justice watching you. We are now bound by the highest levels of scrutiny.”

Also, according to Darwish, only sustainable companies can scale in emerging markets because of the limited resources available to them compared to their counterparts in developed markets. So, he believes unless a company is respectful to the environment and community around its operations, there is no way it can scale.

“There isn’t enough to simply carve out and keep a piece. Companies need to expand their universe of opportunity and benefit collaboratively. That’s what building connectivity does.”

Another strategic reason for choosing the NYSE was due to the capital-intensive nature of the business. After investing billions of dollars, Darwish believes they have barely scratched the surface.

“If you look at Africa today, only about 40% of Africans have access to 3G or 4G mobile services, compared to 85% or higher penetration in the developed markets. On the continent, 5G is only available in South Africa. I believe that internet access will evolve in two ways in Africa; 5G services will be offered to address the high-speed mobile communications needs of consumers and fiber to the home or business will be deployed to solve high bandwidth connectivity demand. Both types of networks are substantially underdeveloped both in Africa and other emerging markets and require billions of dollars of investments.”

Consider IHS’ primary geographies – Africa and Latin America. According to Darwish, the average American consumes about 11GB of data a month compared to 1GB in Nigeria and 2.5GB in Brazil. This means there is room for tremendous growth via the provision of better and broader broadband connectivity. This requires greater access to capital which is best found in deep-pocketed destinations outside Africa.

“Remember the most fundamental premise for telecom connectivity is that every human being wants a bigger, wider broadband pipe no matter where they are or who they are. It’s up to us to satisfy that demand. The Covid-19 crisis taught us that whilst the world could survive with less planes, cars and trains, it couldn’t survive without the phone!” says Darwish.

So where can you find that type of money? New York, says Darwish; the NYSE has 10 times the depth of the London Stock Exchange, he adds, and that was his primary goal.

With the new inflow of capital investment, Darwish has embarked on some key strategic acquisitions.

In October last year, the company signed a partnership agreement with the Egyptian government to erect and lease to MNOs 5,800 telecom towers in Egypt during the first three years of the license term. However, IHS plans to expand further as it believes the country is on an upward trajectory.

The following month, IHS Towers signed agreements to acquire 5,709 telecom towers in South Africa from Mobile Telephone Networks Proprietary Limited (MTN), one of Africa’s leading mobile telecommunications groups.

IHS Towers will also provide Power-as-a-Service (PaaS) to MTN at approximately 12,800 sites across South Africa (including the acquired 5,709 sites). On closing, the company says this will make IHS the largest independent towerco in South Africa. In addition, IHS will become the main towerco in the three largest economies in Africa, further strengthening its leadership position on the continent.

Within the company, the growth trajectory has earned Darwish plaudits.

William Saad, Executive Vice President, Chief Operating Officer and Co-Founder of IHS Towers, talks about his dedication and commitment to success: “Since the first day we co-founded IHS, his focus has been on building strong foundations to be ready for where we are today. Some people dream and talk about their dreams, but, Sam, when he dreams, he turns the dream into a goal and ensures it comes true. That only happens with dedication, long hours, sacrifices, research, learning, planning… and the proof is the size and geographic spread of IHS today.”

“In my five years working closely with Sam, I’ve been wowed by his ability to successfully lead a company operating in so many complicated places. What I’ve seen as truly special, has been his ability to successfully grow the company’s footprint and bottom line while at the same time truly being devoted to employee wellbeing,” attests Mel Immergut, the former Chairman of Milbank, Tweed, Hadley & McCloy.

I believe that internet access will evolve in two ways in Africa; 5G services will be offered to address the high-speed mobile communications needs of consumers and fiber to the home or business will be deployed to solve high bandwidth connectivity demand. Both types of networks are substantially underdeveloped both in Africa and other emerging markets and require billions of dollars of investments.

IHS’ signing of the MTN deal coincided with the completion of an agreement with TIM S.A., a Brazilian MNO and fiber operator. IHS acquired a 51% controlling interest in FiberCo Soluções de Infraestrutura S.A. (FiberCo), a former subsidiary of TIM S.A., which includes TIM’s secondary fiber network and assets, in addition to the provision of fiber optic infrastructure services as an Open Fiber Network Service Provider. FiberCo will complement as well as help further develop IHS’ tower footprint in Brazil (currently comprising of around 5,000 towers) in addition to generating revenue from fiber-to-the-X services.

“Brazil has about 200 million people, and Latin America is a few years ahead of Africa in terms of telecom sector development. FiberCo’s network passes over 6.5 million locations; 3.5 million of which is Fiber- to-the-Home and 3.4 million Fiber-to-the-Cabinets. This deal makes us one of the top fiber players in Brazil and positions us for the imminent 5G growth,” says Darwish. Whilethisdealisattractivefromareturn perspective, the main reason Darwish is excited is because of its importance to Brazil’s 5G network rollout.

“Up until now, location has been the most important part of cellphone network rollouts. FiberCo’s 70,000km of fiber strands run through the busy streets of Sao Paulo, Rio de Janeiro, etc. This network complements the roughly 5,000 towers we own, and the land bank we acquired last year. This combination makes IHS the most strategically placed digital infrastructure operator in Brazil to assist with the rollout of fast 5G networks by MNOs and other telecom operators. Very exciting!”

The new acquisitions undoubtedly make IHS Towers one of the largest telecommunication infrastructure companies globally. The focus for Darwish now is to use IHS’ increased platform and capital base to help advance Africa’s development through further deployment of digital infrastructure.

Loading...