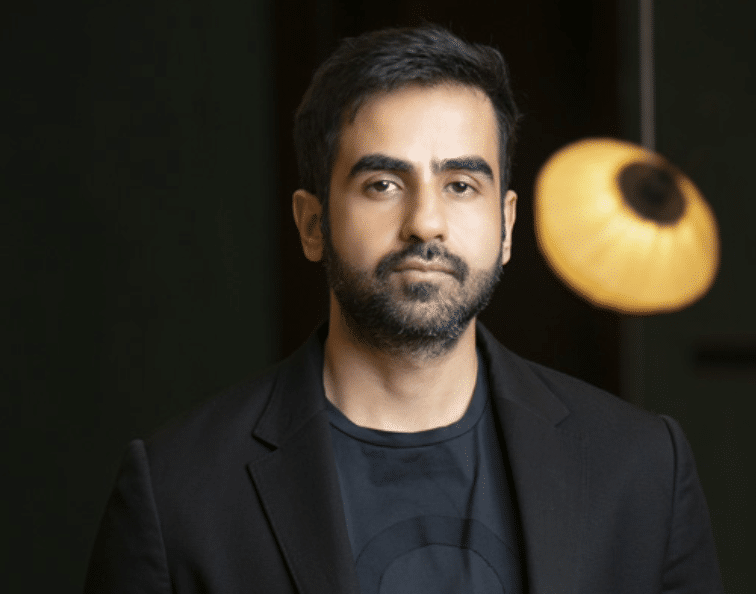

A high school drop-out, Nikhil Kamath is India’s youngest billionaire and with a keen interest in Africa.

IF YOU HAVE A PLAN, DOES IT MATTER THAT YOU HAVE NOT FINISHED SCHOOL? Ask Nikhil Kamath, the 35-year-old co-founder of wealth management firms Zerodha and True Beacon and India’s youngest billionaire as per Forbes India’s 2021 India Rich List.

The big name in Indian stock-broking and retail brokerage dropped out of school at the age of 15 to play chess and developed a passion for the stockmarkets and investing in asset classes. He started equity trading at the age of 17 and his first business at 19. He founded Zerodha and True Beacon with his brother Nithin in the last decade, and together, the brothers were reportedly worth $2.59 billion in 2021.

Today, Kamath is creating wealth for some of the richest people on the planet, with a disruptive product – an open-ended fund with no management fees or entry and exit fees.

This commission-free investing model has drawn comparisons with trading platform Robinhood in the United States.

Loading...

How does he keep this model sustainable in the long-term and how is he looking at African investors? Kamath answers on a Zoom call from Bengaluru, known as India’s Silicon Valley and which is just the setting for his booming fintech.

The man bullish about both India and Africa starts with: “It’s our endeavour to become totally client-aligned, so we have eliminated fixed fees you would associate with a typical fund. It’s a wholesale game in a way, we charge very little, about Rs20 ($0.26) per transaction as an execution fee. We have close to 15%-18% share in the Indian markets, so even though Rs20 does not sound like a lot, with millions of

transactions a day, that adds up to be a considerable number.”

The epiphany for the model came a few years ago when Kamath

was trying to allocate his own capital to private banks and wealth managers and realized the ineptness in the system.

“So to rid the ecosystem of a lot of these inefficiencies, I decided to launch the asset management company (Zerodha), basically building a product I hoped will be available for somebody like me to invest in.”

The seasoned derivatives trader is now eyeing the African market, and hopes to set up base in the continent’s big economies like South Africa and especially Nigeria, for “the new demographic opportunities the region offers”.

India’s regulatory framework is also one of the best that makes it attractive for African investors, a point Kamath concurs with.

“As the world is getting globalized, I think everybody is looking for diversification, not just amongst asset classes but between geographies. So for an African ultra high networth individual (HNI) to participate in India’s growth would be a great opportunity.

“The problem up until now is there haven’t been very many efficient ways of doing it. We are just trying to solve that by providing the connectivity and transparency for these ultra HNIs from Africa to invest in India and get some kind of global diversification. Africa in many ways is a big emerging market for us, and the opportunities are plenty.

“The good thing we have going with India and Africa is there are deep cultural ties going back many decades, and a familiarity with how both the regions have evolved. So I would think it’s natural for increased collaboration and cross-country deals.”

But what does Kamath think of the capital markets and regulatory frameworks in Africa? How would a fund like his work here, we ask, as he hopes to change the nuances of investing.

“What has really worked for India in the last five years is the adoption of technology in the banking and fintech universe. And the regulators have allowed for an ecosystem where this adoption has thrived and happened sooner. Maybe that is a good lesson for Africa, to not go the traditional route of dealing with red tape but to make things more open and integrating technology faster might help reduce the time to get licences and processes working in Africa.”

And coming from a country with a rapidly growing startup ecosystem, the billionaire has advice too for Africa’s young entrepreneurs: “Don’t think too local; there is plenty of innovation happening in different pockets of the world. Actively engage, invest and create, try and learn from the mistakes of others.”

–For the full interview, visit www.cnbcafrica.com

Loading...