Meet the billionaire winners and losers of the dot-com bubble, Great Recession and Covid-19 crash.

Crashes, wipe-outs, recessions. Fortunes are often forged, or fumbled away, in the fire of economic downturns. When the Covid-19 pandemic began to sweep the world in early 2020, the wealth of U.S. billionaires plummeted in lockstep with the stock market. Yet, just six months after the market bottomed out, and with the coronavirus still to be contained, The Forbes 400 richest Americans are doing better than ever, worth a record $3.2 trillion in all. In other words, the pain—at least for the ultra-rich—was remarkably short lived.

So Forbes dug through the archives to compare how America’s billionaire class has fared during and after the past three big market drops: the dot-com crash of the early 2000s, the Great Recession of the late 2000s and the Covid-19 meltdown of this year. Each downturn hit different industries hardest, but a common theme is clear: The billionaires who are down are rarely out, and there are always clever thinkers amassing new riches, even when times are tough.

The Dot-Com Crash

As a huge wave of consumers around the globe joined the internet, rabid investors hoping to get in on the tech boom poured funds into wildly unprofitable startups promising to change the world. The S&P 500 hit a record high in March 2000. Then the bubble began to burst, sending the S&P down 50% over the next two and a half years. Jeff Bezos began an April 2001 letter to Amazon shareholders with a single word: “Ouch.” There were 298 billionaires on the 2000 Forbes 400 list, worth a total of $1.2 trillion; by 2002, the list had lost 73 billionaires and $350 billion in aggregate net worth. Markets, which were also hit by the 9/11 terror attacks, didn’t fully recover until May 2007—more than seven years after the bubble popped.

Losers:

Bill Gates

Shares of Microsoft plummeted 63% in 2001, helping shave $9 billion off Gates’ net worth for the 2001 Forbes 400 (and he’d drop by another $11 billion in 2002). Yet there were promising signs: The federal government announced that it would no longer seek to break up Microsoft, which was just a month away from releasing a new product: the hit Xbox.

Loading...

Monte Zweben

Of the 51 people who fell off The Forbes 400 in 2001, none fell harder than Zweben, who took his ecommerce software startup Blue Martini public in 2000—then watched as 98% of his $1.4 billion fortune evaporated in less than a year when shares nosedived. Zweben has founded and run a handful of tech outfits since, but has never made it back onto The Forbes 400.

Stanley Druckenmiller

The head of George Soros’ Quantum Fund, Druckenmiller struck gold shorting the British Pound in 1992 but eight years later made an ill-timed bet on tech at the height of the bubble. “I bought $6 billion worth of tech stocks, and in six weeks I had lost $3 billion in that one play,” he later recalled. “I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basketcase and I couldn’t help myself.”

Winners:

Mark Cuban

He got rich selling internet radio company Broadcast.com to Yahoo for $5.7 billion in cash and stock in 1999—near the top of the dot-com bubble. Then he made an even smarter move, using collars to protect his Yahoo stock from a price drop, which soon came when the shares plummeted 90% in 2000.

Leon Levy

The investor who helped build Oppenheimer & Co. made more than $100 million shorting the Nasdaq as the market sputtered. When the longtime optimist spoke with Forbes in 2002, he was still bearish about a market recovery. “The outlook for profits is disappointing,” Levy warned.

Thomas Bailey

The founder of mutual fund giant Janus Capital managed to find a way to sell his shares high, even during the market low—thanks to an unusual agreement that gave him the right to sell his stake to Janus’ parent company for a price based on the prior year’s profits. In 2001, with Janus struggling along with the rest of the economy, Bailey decided to sell—forcing the company to purchase his shares for double their market value.

The Great Recession

A real estate market run rampant came crashing down in late 2007, sending the U.S. economy spiraling into a historic recession. The federal government spent some $500 billion on bailouts for the likes of big banks, automakers and insurers. In 2009, more than two-thirds of the list was poorer than the year before as the aggregate wealth of the bunch fell by $300 billion. The S&P, which peaked in October 2007, didn’t make up its losses for five and a half years.

Winners:

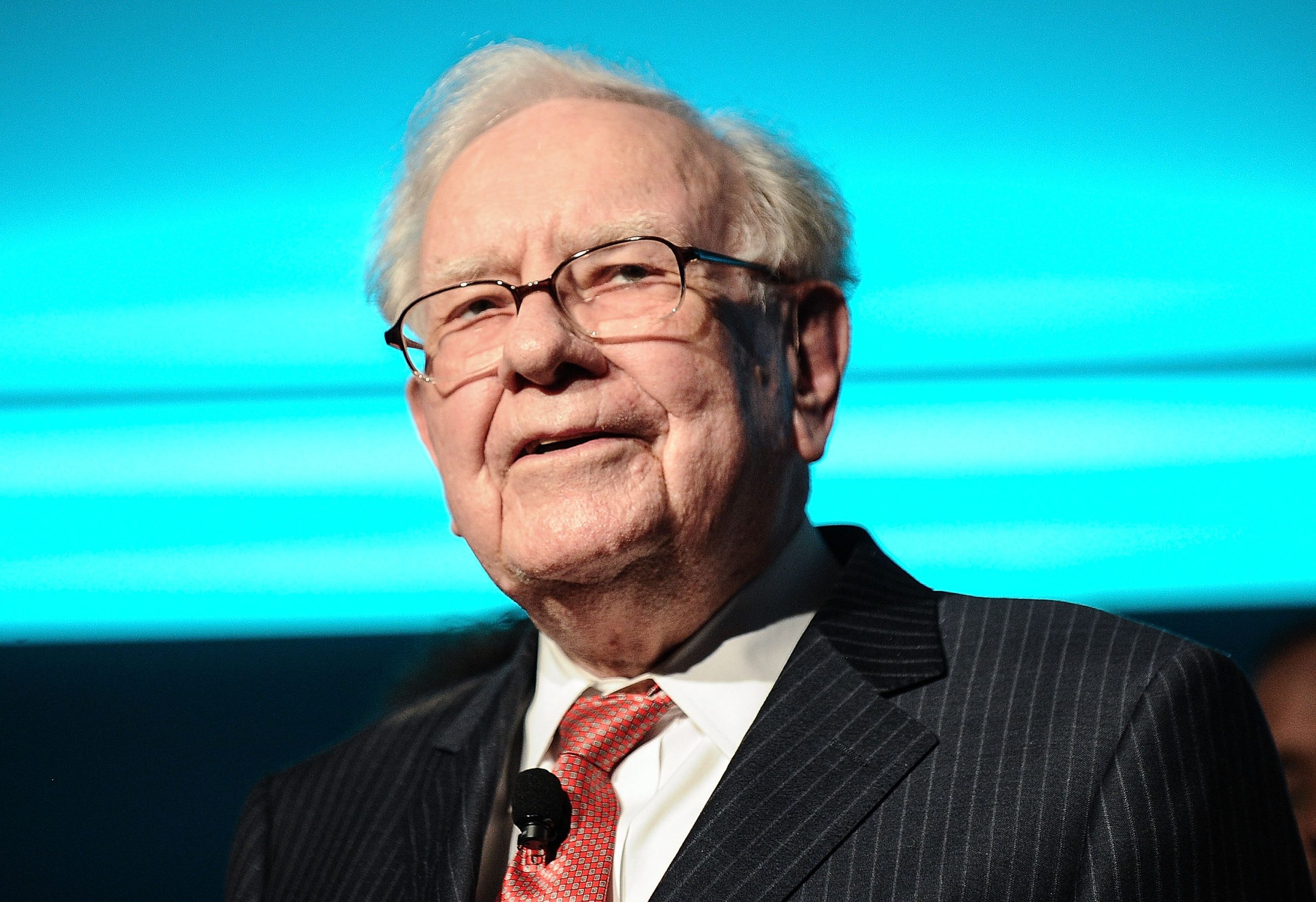

Warren Buffett

The crash hit the Oracle of Omaha hard at first, with Berkshire Hathaway stock tumbling 32% in 2008, along with the broader market. But the famed value investor, who has long preached being “fearful when others are greedy” and “greedy when others are fearful,” used the crash to go bargain hunting. He snapped up preferred stock of titans like Goldman Sachs, General Electric and Dow Chemical on the cheap, bets that earned billions as the companies recovered.

Andrew Beal

In 2004, as personal and corporate debt ballooned in the market runup, the shrewd banker began hoarding cash. He struck when the markets began to tumble in 2007, gobbling up loans and assets from struggling banks for pennies on the dollar, quickly juicing his profits. “This is the opportunity of my lifetime,” Beal told Forbes in the middle of the crisis.

John Paulson

The biggest short: Paulson, a hedge funder who was convinced the economy was on the verge of collapse, began shorting the subprime real estate market before the crash. He pocketed some $4 billion from the bold bet, catapulting him from less than $300 million in net worth to a spot on The Forbes 400 in a single year. By 2008, he’d be worth $4.5 billion.

The COVID Crash

The Covid crash came on fast, with S&P 500 diving 34% from its February 2020 peak in less than a month, as the virus spread around the globe. But, for most members of The Forbes 400, the downturn didn’t last long. The S&P recouped all of its losses in just 181 days, and was again hitting new record highs by August 18. America’s richest billionaires are, once again, richer than ever.

Losers:

Micky Arison

Like other cruise operators, his Carnival Corp. has been crippled by the coronavirus. In early 2020, more than 700 passengers on a ship operated by Carnival’s Princess Cruises reportedly became infected with the virus. In May, Congress said it’s probing the company’s virus policies. (Carnival has said it will cooperate with the investigation.) Meanwhile, shares sunk 68% from last year’s Forbes 400 list through late July 2020, knocking Arison’s fortune down by 31%, to $5.6 billion.

Edward DeBartolo, Jr.

The real estate mogul, who pleaded guilty to not reporting a bribe from a Louisiana government official in 1998, got a presidential pardon from Donald Trump in February. Financially, things have been a bit rockier: Shares of Simon Property Group, which make up much of his fortune, have fallen 60% since last year’s list as America’s largest mall owner reels from the crisis. He and his family sold their DeBartolo Realty to Simon in 1998 for $1.5 billion in stock.

Harold Hamm

“It just grabbed my imagination that anybody could find this hidden, ancient wealth and it was yours,” the fracking pioneer gushed to Forbes about his love of the oil business in 2009. What a difference a decade makes. With a price war and lower demand for fuel cratering oil prices, Hamm’s having a tough go of it these days. His fortune has fallen $3.7 billion since last year’s Forbes 400 as shares of his Continental Resources have dropped 43%.

Winners:

Eric Yuan

With the world working from home, the Zoom founder is cashing in big as his video conferencing app has become a corporate darling. Shares are up more than 500% since Zoom’s April 2019 IPO, launching Yuan onto The Forbes 400 list for the first time, with an $11 billion fortune.

Reed Hastings

His stay-at-home staple Netflix has reaped the rewards of a world in quarantine, with hits like “Tiger King” and “Extraction.” The streaming service has added around 1 million subscriptions a month in the U.S. and Canada, plus another 2 million a month abroad, since the pandemic began.

Ernest Garcia III

Carvana—the “Amazon of used cars” that he cofounded as part of his billionaire father Ernest Garcia II’s DriveTime Automotive Group—is another Covid lockdown hit, with shares up 77% since last year’s list. Carvana, which the Garcias spun out of DriveTime and took public in 2017, allows customers to buy and sell cars online.

-Chase Peterson-Withorn, Forbes Staff

Loading...