Minister Enoch Godongwana says the decision to increase Value Added Tax (VAT) “was not made lightly” as proposal also includes no inflationary adjustments for personal income tax brackets.

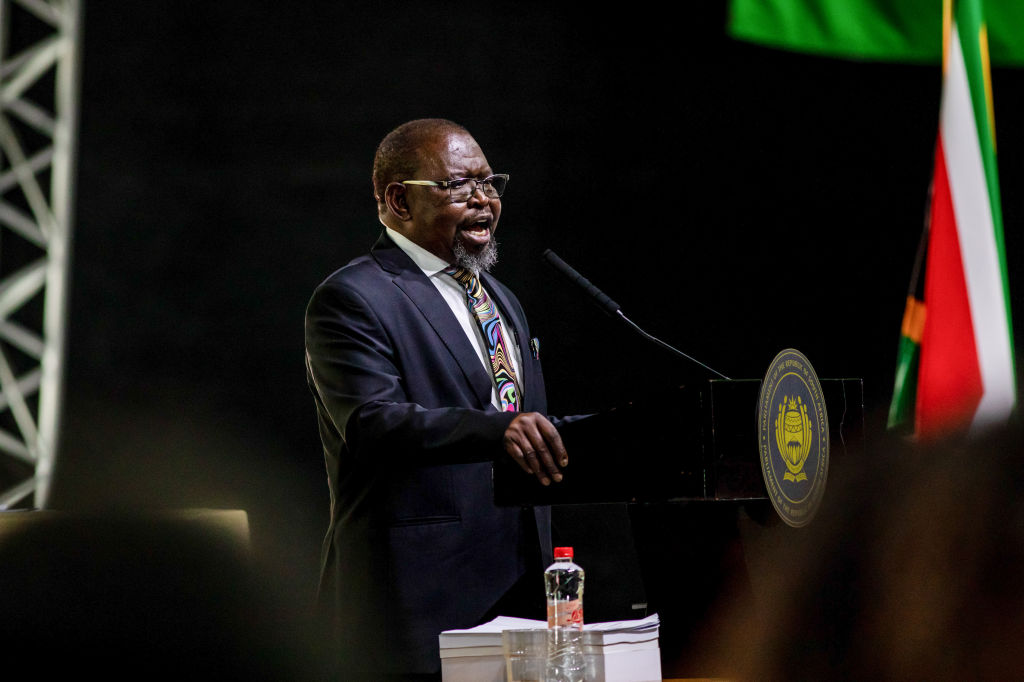

South Africa’s Finance Minister Enoch Godongwana delivered the country’s 2025 Budget Speech on Wednesday, March 12, following the initial postponement of the speech in February.

According to reports at the time, there was a dispute amongst the members of the Government of National Unity (GNU) over a proposed two percentage point VAT increase, which would have put further pressure on consumers.

In the newly-tabled budget, government has proposed to increase the VAT rate by half a percentage point in 2025/26; and by another half a percentage point the following year.

Government has also proposed no inflationary adjustments to personal income tax brackets, rebates and medical tax credits.

Loading...

According to the minister, these measures are expected to raise R28 billion ($1.5 billion) in additional revenue in the 2025/2026 financial year and R14.5 billion ($791.5 million) in 2026/2027.

“This decision was not made lightly. No Minister of Finance is ever happy to increase taxes. We are aware of the fact that a lower overall burden of tax can help to increase investment and job creation and also unlock household spending power,” Godongwana said in his speech.

“We have, however, had to balance this knowledge against the very real, and pressing, service delivery needs that are vital to our developmental goals and which cannot be further postponed.”

He goes on to explain that government weighed up the policy trade-offs, and touches on increases to corporate and personal income tax, as well as taking on additional debt but states that these measures were not feasible.

“VAT is a tax that affects everyone. By opting for a marginal increase to VAT, its distributional effect and impact were cautiously considered. The increase is also the most effective way to avoid further spending cuts and to enable us extend the social wage.”

Other notable points in the speech include the proposed expansion of the list of VAT zero-rated food items, no increase in the fuel levy for another year and the provision of social grant increases that are above inflation.

Speaking on the 2025 Budget, Lullu Krugel, PwC South Africa’s Chief Economist, said, in a statement, that, “Expanding the list of VAT zero-rated products has long been called for by private business and civil society as a way of supporting the financial situation of low-income households”.

“Today’s announcement to expand the basket of goods to include more meat and other products that are widely consumed in the lower expenditure deciles is welcomed with open arms in light of the impending VAT increases. It is now incumbent upon the producers and retail sector to ensure that these adjustments are passed onto the consumer.”

With an overall impression, Althea Soobyah, National Head of Tax, Forvis Mazars in South Africa, said, “One of the biggest issues with the budget every year is that South Africa is not investing in growth-enhancing initiatives with a significant proportion of the budget going to paying off debt and social grants”.

“South Africa urgently needs to look at other ways to increase revenue other than relying on the tax base. At some point it will reach a saturation point. Growth enhancing structural reforms which support small and medium sized businesses will help to address unemployment and grow the tax base. One of the ways to increase the tax base is to grow the employment rate,” she adds in the statement.

Loading...