In FORBES AFRICA’S inaugural list of Top Ceo’s in Africa’s biggest economy, the number-crunching corporate titans attest that in a country that has seen many highs and many historic lows, it’s all about capitalizing on the moment and turning impossible challenges into results-driven success.

METHODOLOGY

FORBES AFRICA’s 2024 Top CEOs is an unranked list of 25 influential and impactful CEOs in South Africa. These leaders are at the forefront of driving innovation, achieving financial success, and contributing significantly to their industries and communities. To qualify for the list, the business leaders must have served a minimum of four years as a CEO. Corporates must have demonstrated positive impact within their industries, including financial performance, market expansion, and development. Businesses must be based in South Africa (may or may not have a presence in different markets in the continent), and showcase the best of executive leadership.

Editor’s Note: The list on these pages follows no particular order.

Covid came and they battled it in cold, socially-distanced boardrooms in the steely citadels of power. Today, it is a bad memory but also a metaphor for how companies can rally the troops and mitigate disease and disaster. For those in the executive stratosphere leading the discourse and diatribe against a herculean virus, it pretty much set the temper and tone for what was to follow: an economy pared down to a bare minimum, and the deployment of survivalist tactics to weather a pandemic-sized storm.

Loading...

Many of the executives in our first-ever list of Top CEOs in South Africa continue to see unfettered opportunities in every scenario, even in the face of the current uncertain economic climate, alongside policies being drummed up by a brand-new coalition government in Nelson Mandela’s Rainbow Nation.

And there’s always the threat of more calamities – an aggrieved climate crisis, glaring food insecurities and more economic exigencies – hurtling towards them.

But their all-time arsenal, as this list of men and women who have made it all the way to the C-suite proved, has been a rolling-up-your-sleeves kind of resilience, drawn from the experiences of their communities and the historic adversities their country has lived down. The reference point for this cohort of leaders is primarily from the tumultous start of this decade.

“We’ve actually, through Covid-19 and through some other areas, realized that we sometimes need a crisis to be our best,” Dawie de Villiers, Group Chief Executive Officer and Executive Director at Alexforbes, tells FORBES AFRICA. “We’ve managed to turn a big crisis into nice successes.”

In PricewaterhouseCoopers’ (PwC) 27th Annual Global CEO Survey released earlier this year, it indicates that CEOs in Africa are more optimistic about growth prospects. In comparison to their global counterparts, 51% of CEOs are more likely to expect global growth to improve in 2024 compared to a 38% global sentiment, reinforcing the longevity of Africa-based organizations.

Evidently, the report from Deloitte shares the same sentiment as PwC as it stipulates that African CEOs managed to adapt to the changes of the world much faster than the rest of the globe.

From the boardrooms to the bourses, much of this resoursefulness may stem from crisis management and the ever-changing and expanding environment that CEOs on the continent have become accustomed to, along with a passion for wanting to redesign, remodel and revamp their business models.

“The impetus to reinvent is intensifying,” the PwC report reads. “CEOs expect more pressure over the next three years than they experienced over the previous five, from technology, climate change and nearly every other megatrend affecting global business.”

The confidence gained by the CEOs on this list has allowed them to look to the future and stay steadfast in their approach to tackling economic challenges, in tandem with South Africa’s new Government of National Unity (GNU).

Shameel Joosub, Chief Executive Officer of telecommunications company, Vodacom, tells FORBES AFRICA that part of being a CEO in South Africa is working with the different ministers and different governments and adopting them as “stakeholders in our sphere”. This, according to Joosub, will allow a company to showcase the initiatives it has, from education to social issues, such as gender-based violence, in order to benefit the country.

“When you enter the conversation, come into the conversation where you are doing things that can transcend governments,” Joosub adds.

“When you’re doing good, that ability to transition from minister to minister, or even if there’s a change in government, not just in South Africa, but across, stands you in good stead. Because you’re not coming into the conversation just thinking about what they can do for you, but you’re coming into the conversation with credibility, and I think that changes the path. So, for me, you carry on with the work and the goal and making sure that you’re shaping the right outcomes.”

Some of these correct outcomes would be the swift adoption of technology in multiple industries. The technology transformation has allowed CEOs to place the needs of the country at the forefront as there is a quicker uptake to reach more people, no matter the goods or services being delivered.

However, there seems to still be some resistance.

A study by Consultancy.eu and AND Digital found that many CEOs admitted the use of technology can be a daunting task; 62% of CEOs are, however, aware of the risk that the slow uptake of technology will have on a business, as the digital disruption continues to scale rapidly.

There has also been an uptake from CEOs turning to generative artificial intelligence (AI) as a catalyst for reinvention to power efficiency, innovation and transformational change. According to PwC’s CEO survey, 70% of global CEOs believe AI will significantly change the way their company creates, delivers, and captures value in the next three years.

In the financial industry, it has proven to be a positive endeavor. This is according to Kenny Fihla, Deputy Chief Executive of the Standard Bank Group and Chief Executive of Standard Bank South Africa.

“We’ve seen the use of technology which enhances the leveraging of data,” Fihla told FORBES AFRICA in an exclusive interview in June. “Banks are sitting on a massive amount of data on the basis of client behavior and so on; that data is not currently being optimally used to benefit clients, to anticipate what their needs are likely to be and proactively offer solutions best suited for them. Suddenly, with AI, we can do that, and we have started to do that as Standard Bank in some of our product offerings.”

Not all industries feel the same.

“Artificial intelligence has the potential in auditing, to really make us redundant as auditors, if we are not careful,” says Victor Sekese, CEO at SNG Grant Thornton.

“And we’ve always been saying before generative AI came into place, we’ve always had this idea to say with the evolution of technology, auditors may be made redundant.”

Many executives have continuously emphasized sustainability as a key pillar in business and it is no different for this tribe of CEOs.

Part of the success of a business has also been to ask the question: how can we improve our country, our communities and the continent? Inclusivity is a crucial factor here.

“When you push for a woman to be in a position… it’s in your interest she succeeds because the sum total of the two of you may make or break the next layer of women coming through the system. I’m saying, let’s have the courage; let’s take the jobs, but let’s be smart, super hardworking; let’s also bring other women into it, because out of self-interest, we need to preserve ourselves in these positions, and not prove [for] the skeptics that actually we should not have been there in the first place,” says Dr Gloria Serobe, WIPHOLD Co-founder and CEO.

Another key area is looking at how impact initiatives can be part of a company’s growth strategies, like looking to entrepreneurship as a pillar of strength for the country as most believe that is where the future lies, leading executives to prioritize business models with education and investment initiatives.

“If I look at South Africa, we still believe there’s massive scope for us with [the] different business units we have,” Gerrie Fourie, CEO of Capitec Bank, says. “And it’s, ‘how do you optimize that, and how do you make certain that you go to the full potential’?”

Richard Hirsch

Hirsch’s

Appointed as CEO • 2020

Exceptionally optimistic for South Africa, for business in South Africa… [we think] there are definitely so many green shoots. We really feel like South Africa has got so much potential. We want to be along for the journey and ride that wave as much as we possibly can,” Hirsch’s CEO, Richard Hirsch, tells FORBES AFRICA.

Hirsch, who became CEO in 2020, says he’s passionate about customer service and makes it a priority to spend time in as many of the physical stores as he can, interacting with staff and customers.

The group recently celebrated 45 years in business. From starting off in a tiny showroom in the country’s KwaZulu-Natal (KZN) province, Hirsch’s now owns 20 branches and Samsung concept stores in KZN, Gauteng and in the Cape.

According to the company, they are the largest independently-owned appliance and electronics retail outlet in South Africa. Hirsch, who took over the reins from his father, founder Allan Hirsch, emphasizes that in a challenging economy, it’s important to know where your strengths lie.

“There are huge challenges out there. I’ve been thinking a lot more that a bigger challenge is being just mediocre. If you’re the worst at something or the best at something, you’ve probably got a much better chance to survive – everybody in the middle is just doing the basics, doing what’s necessary… I think those guys need to [get] a bit of a wake-up. To [succeed], you’ve just got to be a little bit better than the rest. We are striving for that every single day of our lives.”

Hailing from an entrepreneurial family, Hirsch adds that they are always looking to work with other entrepreneurs.

“We go to the small guys to help us. One of the legacies my mom [Margaret Hirsch]… left with us is women entrepreneurship. [She’s] passionate about making sure that women fend for themselves,” he says. “We have networking events every month in every single store; which means small and medium businesses come in and we host them for a breakfast. It’s like a networking event for them. The Cape Town ones are enormous, but it is everyone from people making cupcakes at the flea market to lawyers and doctors… anybody trying to promote their business. We love an entrepreneur.”

Pieter Engelbrecht

Shoprite Holdings

Appointed as CEO • 2017

The homegrown nature of both Shoprite and Checkers is what has led to them becoming Africa’s leading grocery retailers.

According to Shoprite Holdings: “It is important to Engelbrecht that the group is a business with heart, where making profit goes hand-in-hand with a responsibility to the communities in which it operates, to alleviate hunger and narrow the inequality gap through job creation, job security, skills development, nurturing small businesses and providing them with access to market.”

Prior to becoming CEO, Pieter Engelbrecht was instrumental in launching several products and initiatives for the group, such as the Money Market financial service counter, USave and LiquorShop, and reportedly led the acquisitions of Computicket and Transpharm Pharmaceutical Wholesalers. In March, Shoprite Holdings walked away as Company of the Year at the News24 Business Awards. Engelbrecht said the award was a symbol of “ordinary people doing the extraordinary”.

“For me, Shoprite is not a retailer, it’s an institution,” he said, accepting the award.

“I can think of all the negatives if it doesn’t exist, and how many people are dependent on Shoprite and what it does, and why it is an institution.”

Roy Bagattini

Woolworths Holdings Limited

Appointed as CEO • 2020

Woolworths, which was ranked overall best retailer in South Africa, according to a 2023-2024 report by social media analytics company DataEQ, saw a turnover, including concession sales, of R76.4 billion ($4.3 billion) in the 2024 financial year. Roy Bagattini, who was appointed in 2020, has experience in global consumer and retail markets, gained over 20 years.

Commenting on this year’s financial results (ending June 30, 2024), Bagattini said in a statement that the results demonstrate the advantages of diverse portfolios, brands, key competitive advantages, and “the dedication and enthusiasm of our committed teams”.

In 2023, Woolworths South Africa showcased its efforts to pioneer entrepreneurship in the country by launching an annual event, the Youth Makers Competition, for young entrepreneurs to showcase their businesses. This year, Woolworths has invested R2 million (approximately $112,700) to allow these entrepreneurs to uplift their businesses further. At the time of his appointment, Bagattini stated that he was excited about the chance to elevate the brand and “build deeper connections with our customers and, in doing so, realize this potential across all our businesses”.

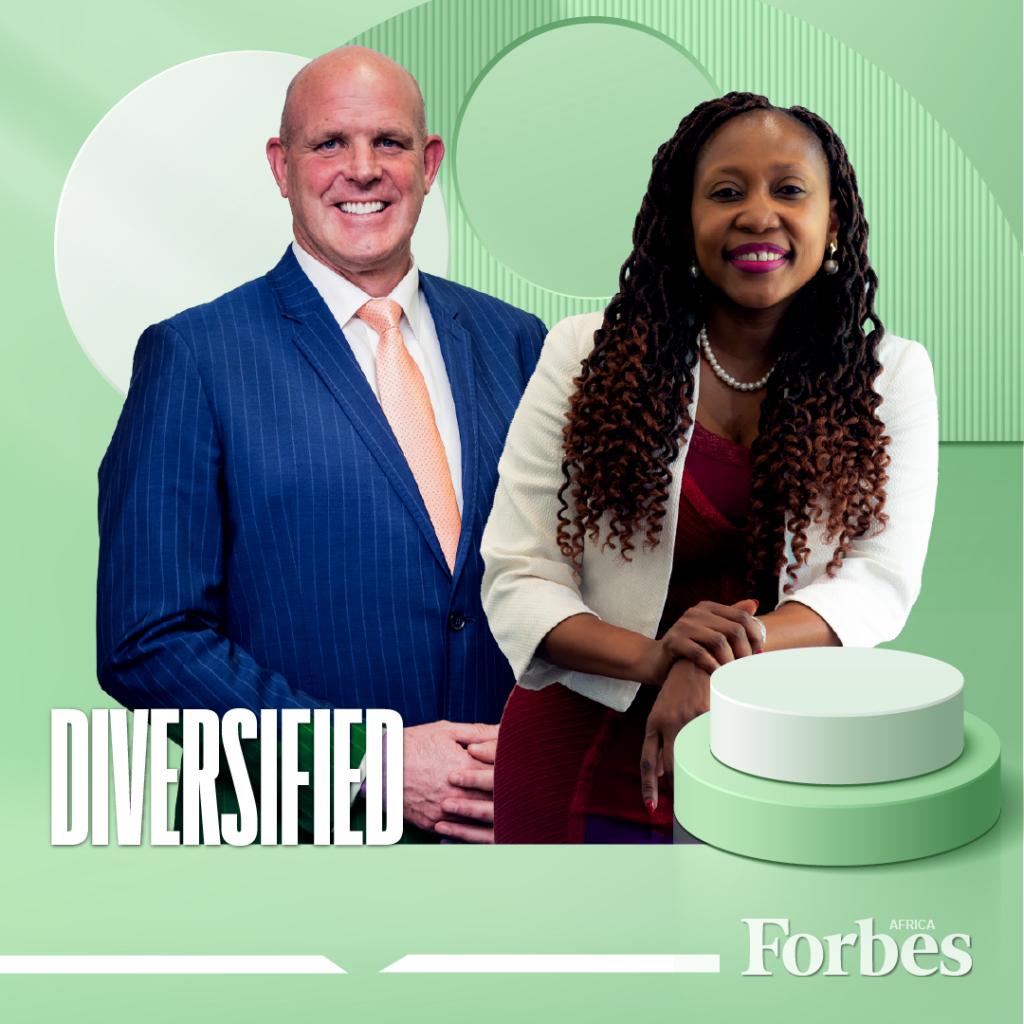

Mpumi Madisa

Bidvest Group

Appointed as CEO • 2020

Leading a staff complement of just under 130,000 employees, as per 2023 figures, Mpumi Madisa broke the glass ceiling when she became the first Black female chief executive of a top 40 company on the Johannesburg Stock Exchange (JSE). Having been at the services, trading and distribution group for over 18 years, Madisa told FORBES AFRICA in March that being the ‘first’ gives others belief that they can also be there.

“Because, generally, we don’t see people who look like us at the C-suite and CEO level,” she said.

“You don’t see enough women, you don’t see enough people of color, and you don’t see enough young women. So, I suppose being the first kind of says, ‘yes, we can; it is possible’. I think it puts a significant amount of responsibility on the incumbent also to make it work and to do it well… At a personal level, I’m very vocal about the fact that when I leave one day, there are more female CEOs in this organization.”

According to Forbes, Bidvest South Africa has a market cap of $4.7 billion and Madisa sits on the boards of around 16 of the company’s subsidiaries.

Dawie de Villiers

Alexforbes Group

Appointed as CEO • 2018

For Dawie de Villiers, a CEO is likened to a coach, and the affinity was not lost on anyone when he sat down to speak with FORBES AFRICA.

“I’ve always thought that I wanted to be a CEO. When I was a youngster, I thought I’d be a CEO one day because I want to run my own thing, make my own plans, and try and win. I love sports; it’s the same analogy [that I use] that you must want to play to win.”

De Villiers’ entire approach to leading Alexforbes lies in ensuring that he motivates his employees through understanding the value they add and with the “intent to do the right thing”. In a way, it’s a business of trust and connection for De Villiers.

“We are a consulting business, so let’s call ourselves advisors,” De Villiers explains.

“It sounds like a small thing, but every individual believes that now, they can do the right thing for their clients. Now, they can pitch up and be themselves, fully, for the client. And if the right answer is not an Alexforbes answer, then you tell your client [what is] and if the right answer is an Alexforbes answer, then you substantiate [it]… and suddenly, clients want to do [more] business with us.”

Financial Services

(Banking, insurance, investment and asset management)

Sim Tshabalala

Standard Bank Group

Appointed • from 2008 to 2018 as CEO of Standard Bank South Africa; from 2017, as the sole Group CEO

Kenny Fihla

Standard Bank Group

Appointed • in 2017 as the CEO of Corporate and Investment Banking/and in 2024, as Deputy CEO of the group and CEO of Standard Bank South Africa

Being Africa’s biggest lender, by Tier 1 capital and assets, is about more than a strong balance sheet.

With total assets of approximately $170 billion and a return on equity of 18.5%, Standard Bank is a continental behemoth.

Sim Tshabalala, who has been Group CEO since 2017, emphasizes that the bank’s operations are driven by Africa’s growth.

In a statement on the recent release of the group’s interim financial results, which saw an increase of 4% in headline earnings to R22 billion ($1.2 billion), Tshabalala noted that the company’s performance was underpinned by continued franchise growth in its banking businesses and robust earnings growth in its insurance and asset management business.

“The South African franchise delivered double-digit earnings growth supported by improving credit trends,” he said.

Kenny Fihla, the newly-minted Deputy Chief Executive of the Standard Bank Group and Chief Executive of Standard Bank South Africa, has worked at the institution for over 18 years.

He told FORBES AFRICA, in an exclusive interview in June, how the bank has incorporated and unlocked support for the small and medium-sized enterprises (SME) sector with his portfolio, also in terms of sustainability-linked financing solutions.

Although Standard Bank has several transformative initiatives, at its tiller, Tshabalala and Fihla remain impassioned when it comes to spearheading projects on climate change and sustainability.

In March, Tshabalala highlighted and reiterated the importance of the company’s climate policy and its targets for sustainable finance.

“By 2030, Standard Bank aims for net-zero carbon emissions from its newly-built facilities, and by 2040, we plan to achieve net-zero carbon emissions from existing operations,” Tshabalala said to business and financial news website, Moneyweb.

Furthermore, Fihla told FORBES AFRICA how the bank has committed to originating and raising, and “putting our own money” into renewable energy projects. Fihla estimated that it could be anything between R250 billion to R300 billion ($14.1 billion to $16.9 billion) in the space of five years.

“We are already 40% of the way there, but there’s still a lot of work to be done,” Fihla said. “That’s just one institution, and given the total amount of money required, it is just not enough. We need the partnerships of a range of financial institutions to enable Africa to have energy security and transition…

“We must undertake it responsibly so that it does not cause hardships for ordinary people. We have partnered with various players and initiated renewable energy projects in South Africa, expanding to other geographies. We have also seen the entry of players who aggregate and generate the electricity and rent out, or people pay based on the amount of electricity they use. And we call those aggregators, because people don’t have to initiate the capital outlay upfront, but rather can pay as they use. And we think that’s going to expand and cover most of sub-Saharan Africa.”

Dr Gloria Serobe

WIPHOLD

Appointed as CEO • 1994

A stalwart in business and all-time champion of women’s empowerment, Dr Gloria Serobe is co-founder of Women Investment Portfolio Holdings (WIPHOLD), along with the group’s Executive Chairman, Louisa Mojela (the other co-founders being Wendy Luhabe and Nomhle Canca). Together, they cultivated a transformative business with a portfolio of strategic investments.

Some of their focus areas include education, financial services, infrastructure, mining and energy, and the food and agriculture sectors, to name a few.

Serobe recalls some of the challenges that the founders faced early on in the business, especially when democracy had first dawned in South Africa and the company had formed, adding that they expected it to be an uphill battle, but perhaps not at the scale that it was.

“We didn’t think that the lack of support for women [was] so severe. That was a bit of a nasty surprise for us, and being dismissed generally. The challenge for us was to be super-bright. We had to work overtime to show that we are up to it, and we had to show strong value-add to our investee companies,” she tells FORBES AFRICA.

“We needed to show that actually it’s not a bad idea to have us as partners. We’re going to be much more active than our male counterparts. We’re going to make it our business to know the business very deeply so that we can add value, whether on the board or in the committees or generally in the strategy session.”

Fast forward to the present day as WIPHOLD celebrates 30 years in business. According to the company, it now has 19,200 Black women shareholders and over R3 billion ($169 million) has been invested on behalf of shareholders.

It’s certainly easier now than it was then for women in business, but Serobe emphasizes that there is still much work to be done.

“What WIPHOLD has managed to do is clear the path for women. There are quite a number of women groups and entities now; it is a little better. It doesn’t mean there are still no big challenges, but it does mean that people have a voice… at least they are not dismissed even before they open their mouth,” she says.

“There are certain industries that are very important to WIPHOLD. One of those is financial services. For us to have a voice in that industry, it makes sense for women to be in all the big banks, and to be in all the big life insurance companies. We can do with a lot of that, because there are certain sectors where we now want our voices to be heard, and it can only be done if there’s more women occupying the space. It’s happening very slowly, but at least it is happening.”

Serobe is leading from the front, having won the Lifetime Achievement Award with Mojela at the 2023 FORBES WOMAN AFRICA Awards.

She was also installed as the fourth Chancellor of the Tshwane University of Technology (TUT) in South Africa in March.

Fani Titi

Investec

Appointed as CEO • 2020

Being appointed a CEO just as a global pandemic was breaking out would have been daunting for anyone. But not for Fani Titi, who took over the reins at one of South Africa’s biggest private banks in March 2020. However, it’s worth noting that Titi had been Joint CEO of the Investec Group, alongside Hendrik du Toit, from October 2018.

According to Investec, his objectives remain to continue to grow and build Investec’s core businesses and deliver the right outcomes for the company’s clients and stakeholders.

A core focus for Titi is sustainability, as he was appointed to sit on the Global Investors for Sustainable Development Alliance in 2022. Being one of only two South Africans, alongside JSE CEO Leila Fourie, he has been tasked with unlocking essential funding for the United Nations’ Sustainable Development Goals (SDGs). Titi, a founding member of private investment group Kagiso Trust Investments Limited (now known as Kagiso Tiso Holdings), has also been non-executive chairman of Investec Limited and Investec plc since November 2011.

Mustaq Brey

Brimstone Investment

Appointed as CEO • 1995

Mustaq Brey has been at the helm of Brimstone Investment since its inception almost three decades ago, with the company’s co-founders raising their initial capital of R3 million ($168,985) from community shareholders. The Intrinsic Net Asset Value of Brimstone, as at June 30, 2024, was R2.7 billion ($152 million).

In an interview in August with CNBC Africa, following the release of the company’s interim results, Brey stated that they would continue to look at the market, reduce debt where they can and carry on trading.

“We’ve got some very good assets – 76% of our portfolio at the period ending now was in food. And those food assets are very good,” he said of the company’s results for the six months ended June 30, 2024.

Sea Harvest, Oceana Group, AON Re Africa and Obsidian Health form part of Brimstone’s investments. According to the company, Brey is as passionate about uplifting communities personally as he is professionally.

Brey, who founded the Saabri & Ashrafi Relief Fund – an organization established to address the needs of communities in Cape Town in South Africa – was also one of three trustees appointed to the board of the Mandela Rhodes Foundation in April. The foundation aims to empower young Africans by providing a postgraduate scholarship and allowing them to participate in a development program, founded on the principles of entrepreneurship, leadership, education and reconciliation.

Adrian Gore

Discovery Group

Appointed as CEO • 1992

The Discovery Health Medical Scheme has over 2.7 million beneficiaries, according to the 2022 Industry Report from the Council for Medical Schemes. Founder and CEO, Adrian Gore, saw the business’ potential early on.

“I believe that it is often during moments of difficulty that the best ideas emerge. Times of crisis can often lead to progress, and hard economic times can be a catalyst for positive change. When we started Discovery in 1992, the country was in a state of political turmoil. We saw an opportunity to create a business that could positively impact the healthcare system and we found a way to move forward,” he told FORBES AFRICA in an interview in 2017.

The company, which expanded into banking and investments in South Africa, and now operates in 41 markets, had a market capitalization of R100 billion ($5.6 billion) as at September 2023.

A noted figure in South Africa’s business community, Gore also currently serves as the Business Unity South Africa (BUSA) Vice President and is on the Board for the SA SME Fund, which specializes in entrepreneurship, investment and venture capital, and the World Economic Forum’s (WEF) Industry Agenda Council on Future Health.

Anton Pillay

Coronation Fund Managers

Appointed as CEO • 2013

Anton Pillay has been the Chief Executive at Coronation Fund Managers for over a decade and, in line with the company’s ethos, has sought to earn the trust of investors.

The company’s 2023 Sustainability Report speaks to the company’s 30-year journey and its Corporate Social Investment initiatives.

“As a proudly South African business focused on the long-term, we are committed to developing our youth to become authors of their future opportunities and not just once-off beneficiaries of our initiatives. We believe that by focusing on literacy and numeracy at the primary school level, we can assist in achieving this,” the report stated.

“In the aftermath of the Covid-19 pandemic, the lack of food security for millions of South Africans has become even more pronounced. Hungry minds cannot learn, and food security is linked to successful learning outcomes. At Coronation, we know it takes a holistic approach to unlock the potential of children and we extend our efforts to include supporting parents, teachers and principals.”

According to the company, Pillay has extensive knowledge of and experience in the investment and banking industry. He is also a director of some of Coronation’s subsidiaries, and serves as the Chairperson of Namibia Asset Management.

In 2022, Pillay was announced as the Chairman of the Association for Savings and Investment South Africa (ASISA) Board of Directors.

Paul Hanratty

Sanlam Group

Appointed as CEO • 2020

Sanlam Group CEO Paul Hanratty has been at the helm of the business since the turn of the century and has been on the board of directors since 2017. He is also a member of the Digital Transformation and Information Technology Forum, the Actuarial Forum, and Chair of the Sanlam Foundation Trust.

Under his leadership, the group announced several company updates in 2024 alone, including the launch of a joint venture brand, SanlamAllianz, in Ghana, after it acquired the necessary regulatory approvals. Prior to this, in June, the company announced it had entered into an agreement to acquire 60% of MultiChoice’s insurance business.

According to a statement from the company on the release of its interim results in September, “strategic acquisitions that the group undertook in 2023 are making valuable contributions to operations”. Sanlam grew its net result from financial services (NRFFS) by 19% per share to over R7 billion ($396 million) for the first half of this year.

“The strategic choice to concentrate our efforts on fortifying our South Africa operations through leveraging our substantial scale and competitive edge, alongside focusing on pan-Africa and Asia where we already have robust market positions in rapidly growing economies, continues to position our business favorably for long-term growth and value creation for all stakeholders,” Hanratty said in a statement.

Gerrie Fourie

Capitec

Appointed as CEO • 2014

“Our DNA is about being entrepreneurial, about being innovative. Our DNA is to find solutions where other people don’t find solutions,” Gerrie Fourie explains.

Leaning back in his chair on a Teams call with FORBES AFRICA, the Capitec CEO says that his passion has always been centered on building something valuable, and on entrepreneurship.

“I saw the opportunity to actually live my passion,” he explains. “And that’s why I joined, because we had some capital, we had a very young, high-level business plan. And how do you start from scratch? My aim was never to become a CEO of a company, probably more a business owner of my own company.

“But I believe what I’m doing today is still exactly what I set out to do, which is to live out my passion.”

Ranked South Africa’s best bank in 2018 in Lafferty’s Global Bank Quality Benchmarking Survey, Capitec reported a headline earning of R10.6 billion ($599 million) for the year ended February 29, 2024.

Fourie believes that innovation is embedded in every Capitec staff member, which is the driving force in fostering a culture of success in business.

“Culture is that you create an ability and organization [where] people make decisions without thinking, because it’s in their DNA.

“That’s what we try to do with getting our culture right by focusing on our clients, people and delivery.”

Ajen Sita

Ernst & Young (EY)

Appointed as CEO • 2010

As many companies discovered, the unprecedented Covid-19 pandemic left them with no choice but to either minimize their staff complement to save money or shut down completely. Ajen Sita tackled it like any other challenge – by asking how the company could remain agile for its clients.

“When we were presented with Covid a few years ago, I remember feeling that was a significant leadership challenge,” Sita tells FORBES AFRICA.

“As a people business, how do we continue to motivate our people, serve our clients, and deliver a strong business performance? We were dealing with so many unknowns, it felt significant. In the end, as an adaptable and resilient business, we were able to remain strong.”

Appointed as CEO in 2010, Sita has been described by Ernst & Young (EY) as a strategic thinker – one who is committed to developing people and transforming the auditing profession across the continent.

Sita says he has never sought out “positions” throughout his career but has been “fortunate enough to have opportunities” presented to him.

“The things I did at the start of my career remain the things I do today, so I would tell my young self to be consistent,” Sita says.

“Be curious, continue to learn and grow, embrace opportunities, and do your best at everything that comes your way. Do that and things will be okay.”

Shirley Machaba

PricewaterhouseCoopers (PwC) Southern Africa

Appointed as CEO • 2019

“One of my greatest learnings is that the sky is not the limit, the universe is. You have to have confidence in yourself before others do,” Shirley Machaba tells FORBES AFRICA.

“Someone who took a chance on me surely looked at my track-record and traits and believed in me, and had confidence that I would not disappoint. When you are afforded an opportunity to do something, perfect that and something great will follow.”

Machaba is the first woman to hold the position as Southern Africa CEO. She also serves on the boards of Business Leadership South Africa (BLSA) and Institute of Directors South Africa; the latter seeks to develop and advance corporate governance.

Machaba says that she sees each challenge as an opportunity. “While having a seat at the table, I lead with purpose and intentionally collaborate to ensure I am inclusive.” On supporting small, medium and micro enterprises (SMMEs), she emphasizes the intentionality of PwC’s strategy.

“We draw on our expertise, and those of external partners, to assist them. Apart from contributing to economic transformation, this approach has enabled us to develop a potential pipeline of new business for the firm. We assisted 33 SMMEs [from] July 2023 to June 2024. We have also been working with nearly 90 businesses to develop them into climate-conscious and compliant suppliers.

“The aim of our Faranani program is instilling a culture of entrepreneurship among women from rural areas. They are trained to address poverty, unemployment and inequality by running profitable businesses. To date, 68% of [the] 4,200 plus women who have graduated from this program are running profitable businesses, creating sustainable jobs and also contributing to the South African economy.”

Victor Sekese

SNG Grant Thornton

Appointed as CEO • 1998

The story of SNG Grant Thornton is one that mirrors South Africa’s journey towards inclusivity and transformation.

In addition to its core competence, the company is recognized for its noteworthy practices relating to gender diversity, racial diversity, as well as environmental sustainability.

Upholding this vision and mission is CEO, Victor Sekese.

“I think there is pressure [to uphold the mission] but I do think, in some regard, it is self-imposed,” he tells FORBES AFRICA.

“But we took it upon ourselves that we wanted to be an example, a model of a responsible corporate South Africa.

“If somebody [were to outline] how corporate South Africa should be in many respects, we [would] aspire to be that firm. We want people to say ‘look at SNG; how they engage their own people, how they lead their people, how they engage with the stakeholders and the clients, and how they contribute to society’.”

One of the country’s largest Black-owned accountancy firms, SNG has 75% Black shareholding and, beyond that, 25% of the firm’s shares are held by women, as per Accountancy SA in 2020.

Shameel Joosub

Vodacom Group

Appointed as CEO • 2012

It’s a chilly September day in Johannesburg, South Africa, as Shameel Joosub prepares to share his notes on his journey as Vodacom CEO since 2012, with FORBES AFRICA. He speaks about the parallel of South Africa celebrating 30 years of democracy this year and Vodacom’s 30-year mark in the country. Joosub has been with Vodafone since 1994, making this parallel even more significant.

The company reported a revenue turnover of R151 billion ($8.5 billion) in May, for the year ended March 31, 2024, with a customer base of over 200 million (with Safaricom).

Vodacom’s impact on the telecommunications industry has not been without its challenges, however, for Joosub, it has always been about focusing on problems and determining how to turn them into myriad positives.

“During Covid-19, many companies basically shut up shop, cut back on their capital expenditures,” he explains.

“What we did is we upped our level of investment. We front-ended it, because we knew people will start working from home, and that’s one of the ways which we out-best [our] competition. So as [they] were pulling back on their spend, we were upping our spend.

“It’s those kinds of technical decisions, or [when we] basically [were] able to build financial services into a major revenue contributor for us. Today, we generate more than $400 billion of transactions.”

The convergence of telecommunications and banking is reshaping the digital payments landscape. This has been a big part of Vodacom’s journey in the African growth story, particularly in looking at ways South Africa can navigate the landscape of mobile money.

The success lies in the services they already provide on the Super App, with more than 1.2 million people using it every day. From this data, Joosub feels compelled to start adding more services and rethinking the way people use mobile money.

“[On the Super App], you can shop, you can pay and you can lend from there. So, we’ve jumped one step ahead because of the high banking culture in South Africa,” Joosub explains. “We already have things like virtual cards as well for online transactions… But we’re crafting our own definitions, we’re doing a lot [with the] merchants, as an example, where we have our own point of sale, and we process over R600 million ($34 million) of transactions every month on the platform. We’re doing lending, we’re doing ordering. There’s a whole lot; yes, it’s not M-PESA (Africa’s most-successful mobile money service), but it’s different.

“I think our purpose is, as we say, connecting for the better future, the emphasis being on connecting. When we started the company, we had a goal, which was to make sure that every South African at the time had access to a cell phone. And in that context, setting that big goal, we created prepaid.

“We changed the face of telecoms across the world. Now our mission is to make it possible for everyone to have access to the internet, and then that drives a whole new perspective. What we’re doing right now is we’re saying, ‘let’s reimagine the problem, how are we going to make it possible for everyone to be financially included’?”

In setting these goals, Joosub underpins his strong focus on employment and entrepreneurship on the continent, from financial services to SME and youth development programs.

“I think corporate South Africa has a role to play. We have the solutions. We don’t have to reinvent the wheel on everything.”

Ralph Mupita

MTN Group

Appointed as CEO • 2020

“I have to stop having coffee at 1PM or else I will not sleep,” Ralph Mupita laughs as he sips his brew and begins the interview with FORBES AFRICA.

There are many hot topics to be discussed.

As MTN celebrates 30 years of being one of South Africa’s largest homegrown businesses, the CEO of this continental telecommunications behemoth has turned many a setback into an opportunity, focusing on impact for the country and Africa.

“What MTN does is give people dignity and it gives people opportunity,” Mupita explains.

“Dignity for a continent like Africa is a big deal, given everything that we’ve gone through, and the opportunity comes in the services we can provide. We allow people in rural, urban areas to have better lives.”

With a reported revenue of $12 billion and a staff complement of over 19,000, according to Forbes, an interesting fact about the man steering the MTN ship is that his journey to CEO was not a conventional one.

“I’m not a telecommunications engineer, I’m a civil engineer, but I started my life in engineering, and then I moved into financial services,” he explains.

“What attracted me to MTN and the MTN story were a couple of things. Firstly, the role and the impact there is to drive digital inclusion, enabling more and more Africans to be connected to loved ones, and for businesses, to be able to scale through [the] capabilities and technology of wireless communication.

“Secondly, [it is] the ability to drive financial inclusion on the African continent, within the context of our mobile money and fintech businesses. What was additionally attractive is the kind of pan-African nature of MTN, in that, although we operate not only in Africa, but the Middle East, there is a very deep-rooted pan-Africanism about the company.”

Food & Beverage

Darren Hele

Famous Brands Limited

Appointed as CEO • 2016

Darren Hele has been CEO of the ‘famous’ branded food services business for eight years. The company, which is home to several South African favorites, such as Mugg & Bean, Wimpy, Debonairs Pizza, Steers and Turn ‘n Tender, to name a few, had an assets’ total of R3.5 billion ($197 million) as at February 29, 2024.

Hele held the Chief Operating Officer title before taking over as CEO of the group.

In Famous Brands’ 2024 Annual Integrated Report, he noted that despite the sustained pressure, the company continued to hold and win market share.

“Our results demonstrate resilience considering the worsening economic and trading conditions,” he said in the Chief Executive’s Report.

The group also added 137 new restaurants to its network, showcasing noteworthy growth.

“From March 2023, we assisted franchise partners with a 1%-point reduction (0.5% royalty and 0.5% marketing) on their franchise fees for sales generated while trading during loadshedding (power outages). By year-end, the total financial relief provided to South Africa franchise partners was R21.6 million ($1.2 million). Around 15% of our sales occurred during loadshedding.”

The company also stated that, as per its contribution to the Sustainable Development Goals, it has initiatives, which include the YES Programme, to increase the absorption of unemployed people into the organization.

To support economic development in the country, Famous Brands spent R1.09 billion ($61 million) on SMMEs, R2.58 billion ($145.7 million) on more than 51% Black-owned entities and R1.91 billion ($107 million) on more than 30% Black women-owned entities.

Anthony M. Leeming

Sun International

Appointed as CEO • 2017

Despite hospitality being one of the hardest-hit sectors during the Covid-19 pandemic and the period after, Sun International CEO Anthony Leeming has steered the company through choppy waters and on towards growth, with the company delivering “a robust trading performance” in its latest interim financial results.

For the six-month period, ended June 30, 2024, continuing income was up 5% to R6 billion ($339 million) and its SunBet income was up 71.8%.

“Through strategic planning, efficient capital allocation, cost management, and a focus on operational excellence, Sun International will sustain its growth trajectory and preserve stakeholder value,” the report stated.

“Sun International is deeply passionate about SMMEs and the role they have to play within our supply chain and the broader South African economy,” Leeming tells FORBES AFRICA. “We also have a focus on increasing our spend with SMMEs, which are at least 30% or more Black female-owned as part of our sustainability targets.” Leeming, who joined the group in 1999, has overseen the acquisition of the Peermont Group and a R295 million ($16 million) expansion of the company’s Sun Vacation Club at Sun City, launched in 2022.

The company indicated that as part of the development, there would be “significant inclusion of surrounding communities in upliftment and skills transfer projects, with a stipulated 30% build value to be allocated to local contractors”.

Some of Sun International’s most notable hotels, casinos and resorts include Sun City, where one can find the iconic Gary Player Golf Course; Grand West Casino and Entertainment World; and The Table Bay in Cape Town; The Maslow Sandton and Time Square, home to the SunBet Arena.

Chris Du Toit

Tsogo Sun Group

Appointed as CEO • 2019

In 2020, Tsogo Sun, one of South Africa’s leading hotel, gaming and entertainment groups, like their counterparts, welcomed the country’s decision to lift the lockdown imposed by Covid-19. Leading the way then, through the tough times, and currently, is the group’s CEO, Chris Du Toit.

Prior to his appointment as Chief Executive of the group in 2019, Du Toit was COO of Tsogo Sun Alternative Gaming (from 2017). He was with the Hosken Consolidated Investments group prior to that, as CEO of one of its gaming and entertainment divisions.

The Tsogo Sun Group announced its results for the year ending March 31, 2024, where its income rose 2% to R11.5 billion ($651 million). Furthermore, in its 2024 Annual Integrated Report, Tsogo Sun stated, “Looking ahead, the group will continue to invest in its solar power generation. Further to this, the group will continue to investigate and implement new energy saving and water consumption initiatives subject to their viability.”

Dr Thulani Dlamini

Council for Scientific and Industrial Research (CSIR)

Appointed as CEO • 2017

Since his appointment in 2017, Dr Thulani Dlamini has steered his focus towards the growth and development of the Council for Scientific and Industrial Research (CSIR) to directly improve South Africa’s science and engineering capabilities, and bolster the support and drive towards industrial development in the country.

“I really see myself as being very fortunate to lead an organization of this stature, with the history it has and the impact it has made across South Africa,” Dlamini said in a 2021 interview with technology and IT publication, CIO.

Having started his career in 1998 as a research scientist in the field of heterogenous catalysis at Sasol, Dlamini was reportedly instrumental in the establishment of the Photonics Initiative of South Africa as well as the progress of a national strategy for the research, development and innovation (RD&I) of photonics. He is a member of the Academy of Science of South Africa (ASSAF) and currently serves on the board of the United Nations Development Programme (UNDP) in South Africa.

“I think South Africa is often held back because we lack the critical mass to really pursue the innovation initiatives we want to drive,” he said in the CIO interview. “We need to get to a point where we reduce our dependence on imports and stimulate local innovation and production in the process. It’s about backing South African ideas and innovations. This is what will drive sustainable economic growth.”

Nompumelelo ‘Mpumi’ Mpofu

Airports Company South Africa (ACSA)

Appointed as CEO • 2020

In 2023, the market size of the global airline industry was estimated at $762.8 billion, according to a Statista Research Department report. Africa may still have a long way to go in strengthening its aviation sector, but that hasn’t stopped the business and leisure travelers from flocking to South Africa’s shores. In the continent’s biggest economy, the conferences are back, and so also the business visitors. The Airports Company South Africa (ACSA) has a pivotal role in enabling this movement, and in the pilot’s seat is Nompumelelo ‘Mpumi’ Mpofu, who was appointed CEO in 2020.

With a career spanning over 25 years, Mpofu previously held three other positions as National Director-General in the departments of Defense, Transport and Housing. Despite operating in a relatively challenging global economic environment, under her leadership, ACSA announced in September that its revenue increased by 16% to R7 billion ($395 million) from the R6 billion ($339 million) reported the previous year.

Serge Sacre

L’Oréal South Africa

Appointed as CEO • 2019

“People love beauty… we want to create the beauty that moves Africa,” Serge Sacre said during a celebration of the company’s 60th anniversary in South Africa in September.

As per Statista, the beauty industry in South Africa was worth over $6 billion in 2023-2024.

In the country, Serge Sacre’s stewardship of one of the most-loved beauty brands has also meant encouraging initiatives promoting social impact. “Looking forward, we will continue to seek out opportunities to touch the lives of those who need it the most, making a meaningful difference in our communities,” Sacre said in a LinkedIn post in July. To FORBES AFRICA, he says: “In a world where beauty often seems exclusive, we are committed to redefining it by embracing the diverse and rich aesthetics of Africa. Our mission is to create products that reflect the authentic beauty of our people, designed by Africans for Africans. This commitment not only celebrates our heritage but also empowers our communities to see themselves represented in every aspect of beauty.”

Loading...