Plans for Nairobi to enter the Global Financial Centre Index (GFCI) – a ranking of the competitiveness of financial centers around the word – finally appear to be on track, following the recent introduction of the Nairobi International Financial Centre (NIFC) Bill. Although the city is yet to be included in the global rank, it’s already among 16 associate centers expected to join the index in the near future.

One of the key roles of the NIFC will be to attract international financial services and multinational corporations to grow and develop the market for financial services in the region. It will help all NIFC-licensed firms to generate new and sustainable revenue streams. On this front, Nairobi is already playing host to several representative offices of global lenders, such as HDFC Bank, Nedbank, First Rand and Bank of Kigali. In addition, the NIFC will provide access to local and regional investment opportunities. Business can be transacted inside or outside Nairobi, in local or foreign currency. This is to allow businesses to operate both locally and internationally. For this reason, plans are already underway to make Nairobi Africa’s first clearing house for the Chinese yuan.

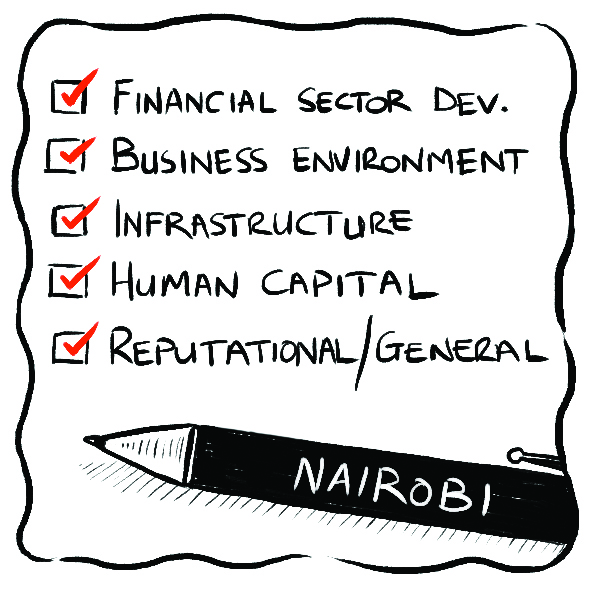

According to the GFCI ranking, for Nairobi to become an international financial center, it will need to enhance five key areas of competitiveness: financial sector development, business environment, infrastructure, human capital, and reputational and general factors. With this in mind, it was encouraging to hear the Cabinet Secretary for the National Treasury, Henry Rotich, propose changes for the local debt market during this year’s budget speech. To start with, market players will now see the introduction of electronic bond auctions which will spare investors from the current manual process of submitting paper bids, the separation of retail and wholesale components of the market and the introduction of primary dealers and market makers. It is likely to attract international portfolio funds looking to investment in the region.

Furthermore, Rotich, through the Financial Services Authority (FSA) Bill will set the stage for mergers across the existing non-banking regulators. The move is expected to address issues around consumer protection, existing regulatory gaps and issues of market conduct. Once enacted, Nairobi’s international status is expected to become even more essential. Some leading institutions have already taken notice. Ecobank Transnational is now planning to upgrade its Nairobi office to be the regional hub of operations for 18 countries. Similarly, global financial services firm, SWIFT, plans to open a regional hub in Nairobi.

A further indication of Nairobi’s increasing competitiveness is the improving business environment. In the 2016 FinAccess survey, Kenyan’s access to financial services stood at 75.3%, up from 66.7% in 2013. But, issues revolving around corruption and rule of law are also key. Kenya would not be an ideal international financial center if its people are corrupt, lazy and lawless. In view of the current financial scandals that have rocked some of the major financial centers, such as the Panama Papers scandal, it’s obvious that reputation is a vital asset that needs to be protected. In fact, reputation has become more important than reality. It is no surprise to see Athens and Moscow at the bottom of the global ranking.

Loading...

While Nairobi gears up for a leap forward, its efforts so far have attracted attention. Kenya was ranked number 42 out of 140 countries by the World Economic Forum Global Competitiveness Report 2015/16 in financial market development. In 2015, the country was also ranked first in the world for leveraging technology to drive inclusion by the Brookings Financial and Digital Inclusion Project (FDIP).

Looking at this trend, it is safe to say that it’s only a matter of time before Nairobi catches up with the big boys.

Loading...