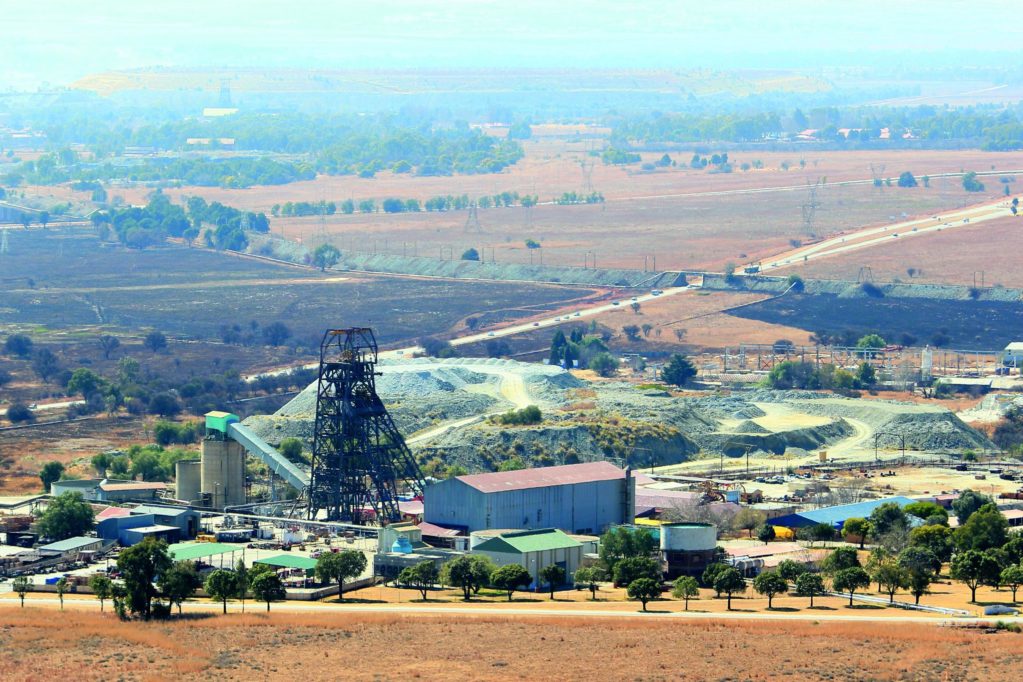

Carletonville, 60km west of Johannesburg, is a town teeming with miners, but on this day there are none to be seen. The reason: a gold miners’ strike over pay for the first time in more than six years.

It is a strike that cost the gold mining industry 15,900 ounces of gold production a day, meaning losses of $23 million daily, according to Kobus Nel, a mining analyst at Stanlib in Johannesburg. The strike will dent the share prices of South Africa’s largest gold miners: AngloGold Ashanti, Gold Fields and Harmony. The reason—one of the most fractious rounds of pay talks in South African mining history. The negotiations, held every two years, are crucial for planning for the industry as wages make up more than half of mining costs.

The gold companies thought they were going to have an easy ride this year with inflation at around 5%. The employers hoped to settle swiftly for between 8 and 9% and many labour analysts agreed. Employers were, however, flabbergasted in May when the National Union of Mineworkers (NUM)—the most powerful union in the land—asked for 14% and a package of costly demands. The employers calculated that these demands translated to an effective 25% increase in costs. Elize Strydom, the chief negotiator for the employers, described the demands as “disappointing and distressing”.

An opening offer of 4% was rejected with disdain by unions. To complicate matters further, the gold companies were divided. AngloGold Ashanti and Gold Fields were happy to raise the offer, while Harmony, with its old and marginal shafts, stuck to a lower offer. The unions in South Africa are on a mission, encouraged by a record high gold price, to close the wage gap between the lowest paid, toiling with shovels, and the highest paid, sitting in boardrooms. “These employers have rested on their laurels for too long—we want 14%, or we will strike,” said Lesiba Seshoka, the national spokesman for the NUM. It all boiled down to a deadlock at an offer between 8 and 9% on July 25, followed by an all-out gold strike three days later.

Loading...

On the day, AngloGold Ashanti and Harmony were down about 3%, closing at R281.11 and R91.19 respectively. “If the strike lasts a week, the loss of production will represent 6.5% of quarterly production, quite a hit on the industry,” said Nel.

Surprisingly, Gold Fields closed flat at R103.50. Nel said Gold Fields may have been unscathed because it had already been aggressively sold o‑ due to its exposure to Peru where there was a threat of an increase in taxes. With stock markets forward looking, much of the negative impact of the strike had already been priced into the shares .Also on the day, investors were jittery about the European debt crisis and the political brinkmanship playing out in the United States over the great debt limit saga. These fears kept investors buying gold, pushing the price to record highs. Nel expects the gold price to rise and rise in the months to come. He sees it peaking at $1,677 per troy ounce in the first quarter of 2012.

AngloGold Ashanti, Gold Fields and Harmony the day after the commencement of the strike were relatively flat closing at R281.00, R103.60 and R90.75 respectively. All in all, the last week in July proved an expensive one for South Africa’s three gold giants and their shareholders.

Loading...