This article has been translated and republished with permission from Forbes Africa Lusofona. This article first appeared here.

“Our vision remains as clear as ever, as does our determination to seize opportunities inside and outside Nigeria. Angola represents an opportunity for our shareholders to participate in what we believe will generate stronger value as Africa emerges. We remain committed to making these disciplined and well-structured investments to create a strong and holistic platform that will be competitive, diverse and attractive for years to come”, says Herbert Wigwe, CEO of Access Holding Pics, exclusively for Forbes África Lusófona, regarding the binding agreement with Montepio Holding SGPS SA to acquire a 51% majority stake in Finibanco Angola SA

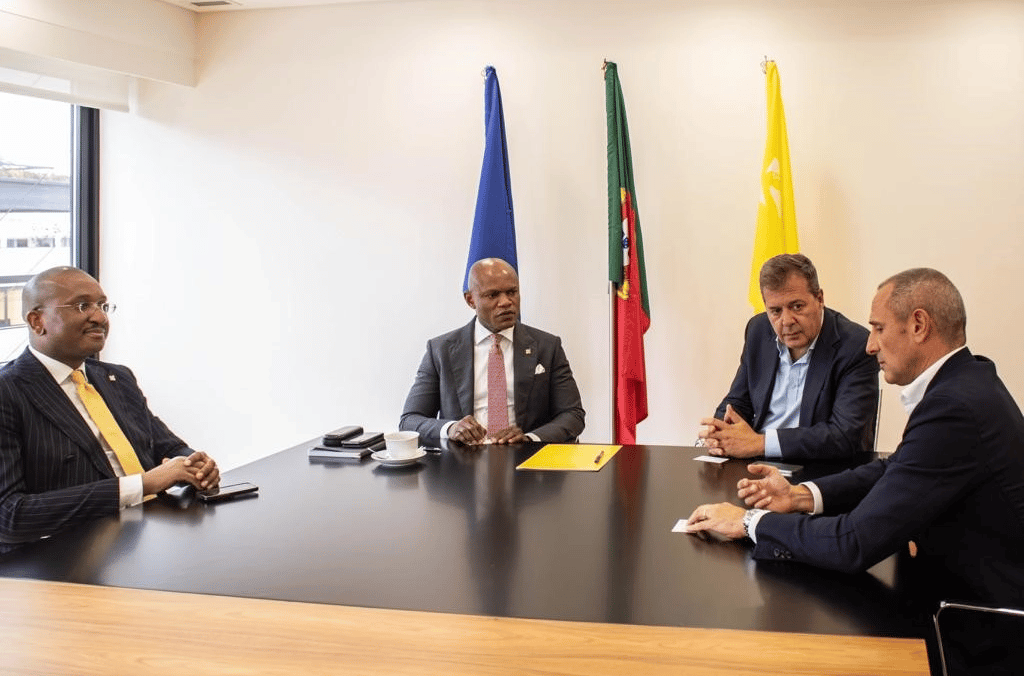

The acquisition, signed after the signing of several agreements (pictured), is subject to regulatory approvals in Nigeria and Angola, and is expected to close in the first half of 2023, after fulfilling the conditions precedent, Forbes has learned. At the same time and in a statement, Banco Montepio adds that “the sale value will refer to the proportion attributable to the Banco Montepio Group in the equity of Finibanco Angola SA, which totals 70 million euros with reference to June 30, 2022, and the adjustments that may be determined within the scope of an audit scheduled for completion in the second quarter of 2023”.

“For MH and for the broader Banco Montepio group, this is an important step in its strategy of concentrating its activity on the domestic market and, at the same time, opening new paths for the future of Finibanco Angola, which it helped to develop during more than a decade under its ownership”, says the document.

For Access Bank, “the transaction furthers the Bank’s strategy of being Africa’s payment gateway to the world, while working with other continent-focused multilaterals to provide robust and efficient payment platforms and ecosystems.”

It should be noted that Access Bank has a network of more than 700 branches and service points on three continents, with 45 million customers. and 28,000 workers in Nigeria, as well as subsidiaries in Sub-Saharan Africa and the United Kingdom, in addition to a subsidiary in Dubai and representative offices in China, Lebanon and India.

Loading...

Finibanco Angola SA is a commercial bank with more than 20 branches and around US$300 million in total assets that has been operating in Angola since 2008.

Loading...