London could be Nigeria’s 37th state. From the underground to the finest hotels, you can hear an army of Nigerians on the march. There is an attitude about them – forward thinking, money spending – a force steeling Britain’s economy with streetwise Lagos cut-and-thrust. Be it academia, business, or just plain rich, there is plenty of Nigeria to go around in London. One of the best known is the Nigerian billionaire, Femi Otedola, who owns a $53.5-million home in the heart of rich Knightsbridge.

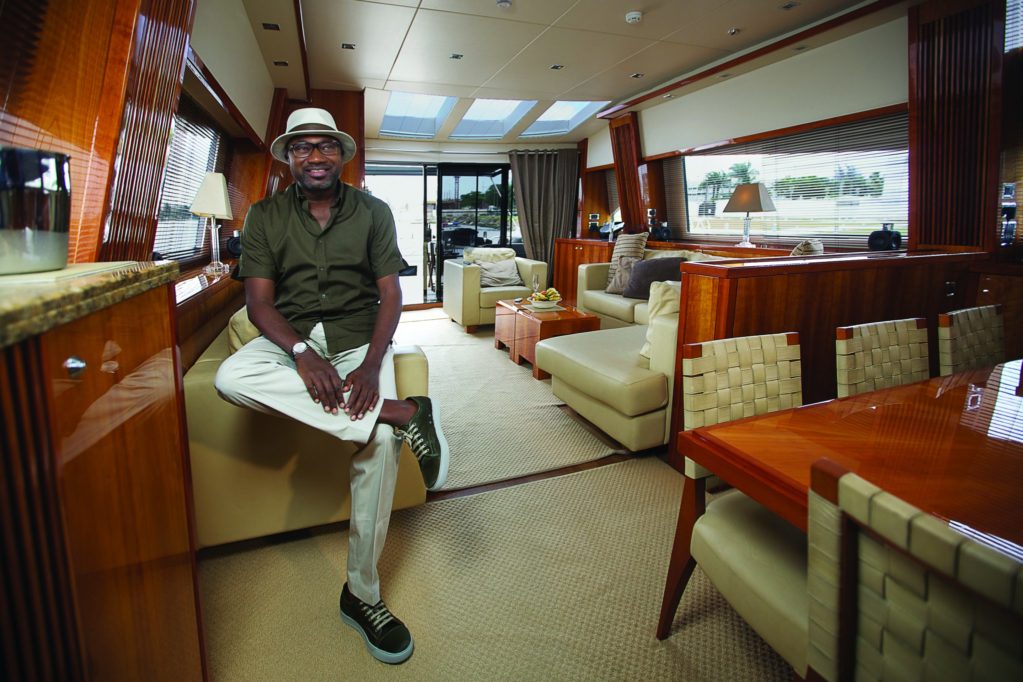

Otedola, the man who always wears white, clearly doesn’t believe in doing things by half. He owns a fleet of custom Rolls Royce cars in London and a Mercedes fleet in Nigeria, together worth $7.7 million. On the waters off Lagos, he has a sleek, custom-made, $19.5-million yacht in the Victoria Island lagoon. His home in Lagos is bigger than the one in Knightsbridge, with more expansive balconies and better weather.

Be it homes, gadgets or cars; Otedola appears to love the good life and doesn’t mind spending on it.

On a Thursday morning, in his tastefully furnished London pad adorned with family portraits, we meet for a chat; Otedola is jolly, answering phone calls and checking stocks on his tablet. He does this every morning after a few hours in the gym. There is no doubt it has been another prosperous year for the chairman of a leading Nigerian downstream oil company.

Loading...

Otedola was the second Nigerian to make the FORBES billionaires list in 2009. Following a major plunge in the shares of African Petroleum (now Forte Oil), he fell off the list. Another blow came when he topped the list of Nigeria’s debtors – owing banks around $900 million. Otedola has since reshuffled his finances and paid off every cent, according to the Asset Management Corporation of Nigeria (AMCON). He returns to the FORBES rich list in 2014 wealthier and wiser. He is worth at least $1.2 billion, as valued this year by the FORBES wealth unit in the United States and FORBES AFRICA. The rise in net worth was helped by a spike in the share price of his company, Forte Oil where he owns an 80% shareholding.

Otedola is part of a group of relatively young men who represent the new face of Nigerian capitalism. Born around the sixties and seventies, they came of age in the eighties and nineties as Nigeria inched deeper into military dictatorships that crippled the economy and the ambitions of entrepreneurs. They had to wait until the return of democracy in 1999 – and the subsequent opening up of the economy – to unleash their entrepreneurial skills. They have since taken advantage of the upturn in the country’s fortunes; their rise coinciding with waves of Nigeria’s economic reform.

So, how do you run up $1.5 billion in debt and become solvent in a few years? Just ask Otedola, who believes it was something he had to go through that had an echo in his childhood.

“I had my first business at the age of six. It was called FEMCO. I’d offer to groom my parents’ guests’ nails. Then, write a receipt and charge them for my service. They paid me too. I always had an interest in business. For my seventh Christmas present, I remember asking my dad for a briefcase. I just thought it was a good look. He gave me one of his and I insisted on taking it to school with me. The kids laughed at me, but I still loved the briefcase.”

Down the years, Otedola nursed his passion and grew up to work for his late father, Michael Otedola, the former governor of Lagos State.

It was a career that began with inky fingers. Otedola ran the marketing side of the family printing press in the late 1980s. It was a springboard to becoming a name in the world of Nigerian business.

An insight into the way Otedola’s mind worked came years later in a very public feud with his now best friend and one-time business partner, Aliko Dangote – the richest man in Africa. The squabble was over a bid for the Nigerian arm of Chevron, Texaco’s downstream business, which the company put up for sale in 2006. Otedola – the oil-and-gas man and second largest shareholder in Texaco at the time – was beaten to it by a company with links to Dangote, the cement-and-commodities man; a move said to be in violation of a gentleman’s agreement to respect each other’s turf. When Otedola announced that he would be investing in sugar and cement factories – Dangote territory – few missed the dig in the ribs.

The squabble lingered, but the storm passed, leaving the two men closer than brothers. A nautical manifestation of this is their identical yachts that bob side-by-side in the lagoon off Lagos.

“It was a case of conspiracy theories. Aliko and I have a genuine relationship and it was only natural that we had a few differences along the line. Today, he is my mentor. I like his sincerity and integrity. Aliko’s word is his bond and I have a lot of respect for my friend. I believe he is a real blessing to Nigeria and Africa as a whole. He is a godsend to this continent. I believe Aliko is highly underrated too. He will become the richest man on the FORBES list someday,” says Otedola.

TO GO WITH AFP STORY IN FRENCH BY JACQUES LHUILLERY ******Nigeria-économie-énergie-société-politique***

(FILES) File picture of Nigerian businessman Aliko Dangote (L) and Femi Otedola are pictured during the opening of the second Lagos domestic airport MM2, 7 April, 2007. Aliko Dangote said that he is far more wealthier than US TV anchorwoman Oprah Winfrey which US magazine Forbes said her wealth fetches USD 1,5 billion. AFP PHOTO / PIUS UTOMI EKPEI/FILES

Otedola’s foray into the oil business began after he stopped working for his father and started working for himself.

Being the son of a governor, Otedola had friends in government who supplied him with diesel. Friends that didn’t do his business any harm down the years. When the political climate changed, the supply stopped. He made enquiries and approached a company for fresh supplies of diesel.

The light bulb in his head went off when Otedola saw a clanking, broken-down truck deliver supplies to his house three days after placing the order. He decided to open his own, more efficient, diesel supply business.

“I started buying diesel from a guy who had control of the market for retailing. I soon realized that a lot of companies in the country actually used diesel. I once received an order from a big transport company. The banks were closed and I could only offer a cheque. I was my supplier’s biggest customer but he refused to take a cheque from me. I immediately realized I needed to source alternative methods of getting my diesel.”

With outrageous ambition, Otedola approached the new management of the depot, which was worth $4 million, and offered to buy it for $20 million.

“I contacted Zenith Bank, sold my pitch on the venture and how we would finance it. I had a meeting that barely lasted 10 minutes with Jim Ovia (another billionaire on the FORBES rich list); he believed in me and it was a done deal. This was in 2003.”

Soon, Otedola had full control of the diesel supply infrastructure with his company, Zenon Petroleum and Gas Limited, holding 91% of the market. It turned out to be a great business decision. He set up a transport and shipping company in line with the logistics attached with diesel supply – F.O. Transport and Seaforce Shipping. At a stroke, he took control of the entire chain. He went further to diversify into property and buying into a string of other large companies. He was 35; he felt the adrenalin rush and wanted to dominate the market. All this in a mere seven years.

At this point, Otedola’s biggest competitors were oil giants Total and Mobil. Soon, he was setting the diesel price and supplying his competitors.

“While my competitors were sleeping, I was busy strategizing. I was liberal too. My strategy was: high volumes, little margins. I was very excited at this point. However, I knew that at some point the government would fix the power issue (diesel is mainly used for generators during power cuts) and I needed to move a step forward.”

In what proved a wise move to cushion the business, Zenon bought a 28.7% stake in African Petroleum. Zenon invested aggressively across the financial sector becoming the second largest shareholder in Zenith Bank, largest individual shareholder at United Bank for Africa (UBA) and many more banks in Nigeria. As the banks sought share capital, following a new directive from the reserve bank, many approached Otedola. He rolled the dice in the knowledge he was playing safe.

At that time, Zenon was very solvent and the largest diesel importer in Nigeria. It invested a lot of money in African Petroleum with Otedola increasing the shareholding from 28.7% to about 55%, at a cost of $400 million. Then, the worst happened – the crude oil prices plunged from $146 to $36 in 2008.

“We took a very big hit and I lost about $1.5 billion, plus interest, in the process. When the oil prices were dropping, I saw it all coming. I could see myself losing big money. I had diesel worth $400 million on the high seas. It didn’t look good. I’m a capitalist though. It was great while the money was rolling in. Now that I lost so much, it was also time to face the tune. It was a very low time for me and I explored different options, including suicide, but ultimately, I knew I had to solve this problem. My debts had to be paid.”

“The same banks that had once sent pretty sales ladies to get money from me for their accounts in the past were now sending tough looking men to knock at my door to get me to pay my debts in the mornings. The only people I’d credit at this point were my wife for her great support, Jim Ovia of Zenith Bank and Segun Agbaje of Guaranty Trust Bank who understood the situation and offered a restructure of the loans for ease of payment. I was however determined to pay it all up and move on. The banks sold the debt to Asset Management Corporation of Nigeria. It was a total of N200 billion

($1.2 billion).”

Otedola separated his personal fortune from his business, so Zenon was bankrupt but he wasn’t. AMCON bought the debt for $867 million. They valued the Zenon assets, Otedola’s property company and existing assets. He added some cash and there was a court settlement. He had also started selling his bank shares, before the big plunge. It dragged on for four years.

“The most important lesson I learned, is that no one is invincible. No matter how high up there you are today, you can lose it all tomorrow if you’re not on top of your game. I also learned that being a good entrepreneur does not necessarily make you a good business manager. I learned to keep my hands off managing and leave it in the hands of experts.”

Today, Otedola describes his approach to business as very risk averse and content. Having sold all the Zenon assets to pay his debts, he shifted his focus to African Petroleum which had to go through restructuring.

Otedola’s fingers were burned and he was going to be tougher this time around. In 2011, a complete overhaul saw him sack all staff at African Petroleum, albeit with a handsome severance package. In the restructuring, African Petroleum became Forte Oil.

“I also made a decision not to run the business as I had failed at running it well. I then brought in a crop of fresh young talented guys to take over. I wanted fresh, brilliant minds and ideas. I wanted to build an institution based on the best corporate governance practices; a whole new direction.”

Forte Oil owns about 500 retail outlets across the 36 states of Nigeria. Its audited half year 2014 results show growth. Its revenue grew by 33% to $511.18 million as against the $385.03 million in 2013. Contributing significantly to revenue, for the first time, is the company’s power generation segment from Amperion Power. Under Nigeria’s power privatization program, it acquired the 414MW Geregu plant in Kogi State. Overall sales costs increased by 30% to $453.39 million from $348.20 million in 2013. Gross profit surged by 57% to $57.79 million from $36.82 million while profit before tax grew by 152% to $26.92 million from $10.68 million.

Alongside recovery in underlying business performance, exposure to the power sector acted as a catalyst for a rise in the share price at Forte Oil. The company has aggressive ambitions and is on the brink of a big deal.

On returning to the FORBES list, Otedola says: “It is good to be back and is simply an indication of how well we are doing.”

On family, he says: “I’m extremely dedicated to my family. They come first at all times.”

Speaking of family, Otedola’s daughter is on the way up through turntables rather than oil barrels. Florence Otedola, one of four children who is also known as ‘DJ Cuppy’, plays and produces music on the dance floors and flies around the world to spin the tunes.

“Cuppy is a very smart young lady who will go places. She has done very well and is currently in the United States for her Master’s program. She is very talented at her DJing. It is her passion and I have no choice but to support her. I want my children to follow their respective passion and I’ll support them to the best of my ability.”

Otedola believes Nigerians are enterprising and therein lies the country’s strength. He detests the bad light in which Nigeria is often seen and hopes for fairer reporting that celebrates its successes as well.

“I’d like to see a Nigeria with about 50 Dangotes,” he says on Nigeria’s future.

As the FORBES list welcomes Otedola back, he is looking towards a brighter future and increasing his $1.2-billion wealth. He may have made a small slice of FORBES history by making a billion, losing it and clawing it back. Either way, he is burned, humbled and bouncing back – w

Loading...