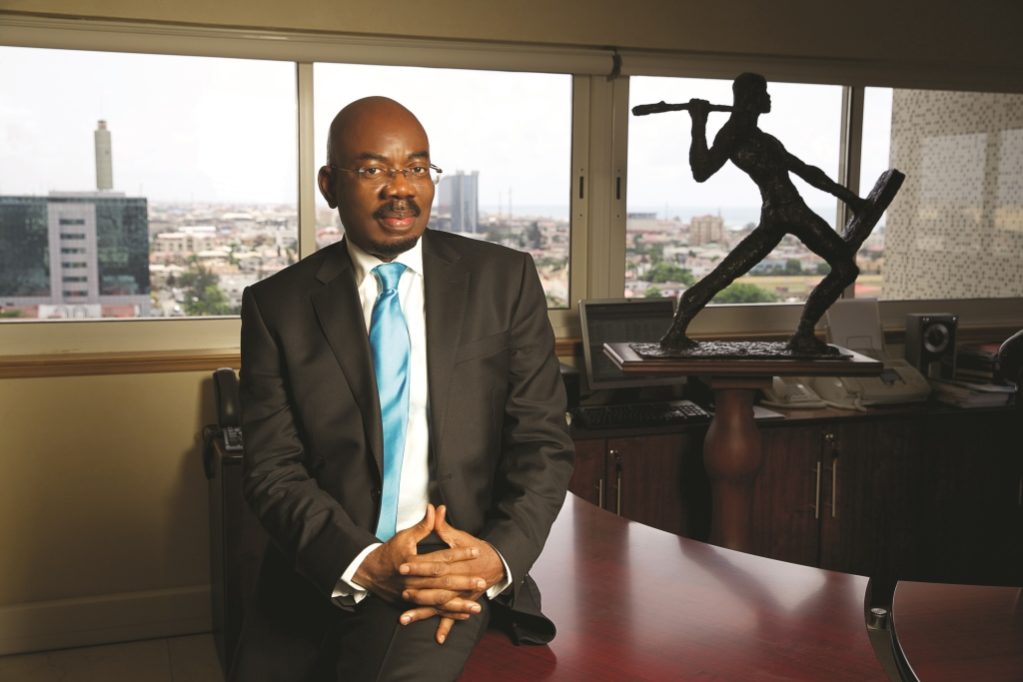

It’s 10AM on a Thursday on Victoria Island, Lagos; the pulse of the Nigerian financial world is racing. Blue-chip boardrooms buzz; so does the traffic. I’ve eased my way to the serene offices of a man who surveys it all from the 12th floor.

The view is framed by the Atlantic Ocean to the south and some of Nigeria’s richest buildings to the north. From his vantage point, Jim Ovia can pick out the twin pillars of his success. Across the city is the unmistakable red of Zenith Bank, where he made most of his $825-million fortune. Company insiders say that his wealth is nearer $1 billion after a string of lucrative deals this year. Also on the Lagos horizon are Visafone billboards, his telecommunications business and moneymaker, with a current subscriber base of around 2.3 million.

Inside the huge office are shelves of plaques, awards and photographs of Ovia with Bill Clinton, Arnold Schwarzenegger and Goodluck Jonathan, alongside pieces of literature and art.

Dressed in a well-cut suit, he greets me like an old friend. They call him ‘the godfather of Nigerian banking’ and in many ways, he is. Banking is where he began life as a clerk; it was also the vehicle that carried him to his fortune. He created West Africa’s largest financial services provider, according to market capitalization and assets.

Loading...

Ovia transformed Zenith from a small commercial bank into a financial services conglomerate, with operations in private and retail banking and investments around the world. After nearly two decades at the helm he stepped down, but he remains its largest individual shareholder with a 15% stake in the company.

“When we started Zenith in 1990, it was extremely difficult as the necessary resources and infrastructure to do business, particularly banking, were not in place. There were no ATMs, no mobile phones and ICT was a rarely known concept in the business space,” he says.

“When, in 1990, banking licenses were being issued, indigenous private individuals were being offered the opportunity to set up financial institutions. Prior to that, you either needed to be a foreign global financial institution, or a federal or state government institution, to own or set up a bank in Nigeria. Businesses and entrepreneurs could not possibly get these licenses because of the prerequisites attached. It was perceived then, that Nigeria did not have the technical expertise to run or manage banks.”

A surge of liberalization soon changed this. On May 30, 1990, doors were opened for Ovia and 119 other hopefuls, who received their bank licenses. It was a long-awaited breakthrough. Ovia and his team got down to work quickly. They commenced operations on July 16 for what proved to be a rocky beginning, with technology very thin on the ground.

Improvisation was the way forward. Ovia had to be creative with the sparse telecommunications and financial services on offer. In time, with the help of improved infrastructure, the bank found its feet.

Ovia saw a silver lining, then noticed the cloud. The introduction of ATMs to Nigeria was not an easy one. It proved difficult to win over people who had grown up with counters and rubber stamps. People worried about fraud and it also took time and feasibility studies to decide where to place the ATMs. Ovia and his team persevered and Zenith blossomed.

Banking isn’t Ovia’s only game. He also owns an expansive real estate portfolio with landmark commercial and residential properties. These include the Civic Centre and an exclusive boat club, Aquamarine in Lagos, where Africa’s richest man, Aliko Dangote, is a member. Ovia is known to have a weakness for expensive boats.

It is his infectious entrepreneurial passion that paid for this lifestyle.

“Your passions are always in sync with opportunities. You’re naturally able to identify them and respond to them as they materialize because of the passion you have for them,” he says.

It is an intuition that has driven Ovia through life as an entrepreneur. Choices came early for the young Ovia, who grew up one of many children in a large family in Akbor in Nigeria’s Delta State. As a young man, Ovia pondered what to study. He was encouraged by his uncles, who had run successful businesses, to pursue a qualification in business administration. To this day, for most Nigerian families, business administration, alongside medicine, law, accounting and engineering are the keys to success. Ovia went for it and enrolled for a degree in business administration at Southern University, Louisiana, in the States.

“It so happened that halfway through my studies, my keen interest in computer science and information technology was heightened… I couldn’t help it and decided to incorporate computer science into my program. One of my uncles advised me against this, as he reckoned that it was an immature industry at that point. Business administration was the way forward,” he says.

Ovia carried on regardless of avuncular warnings.

“Like any young man, I was full of hopes… [there were] tremendous opportunities in the future. It wasn’t so much what you studied but what you did with the knowledge that mattered.”

Ovia earned an MBA from the University of Louisiana, after which he returned to Nigeria to do his National Youth Service Corps, where he worked with one of the government-owned banks. He secured a job with First National Bank of Chicago—then International Merchant Bank—in Lagos, where he was trained as a financial analyst. This was just one of many strings to Ovia’s bow.

“I’ve worked as everything, from a junior clerical officer in a bank to a middle management trainee. I really did work my way up the ladder. I had enjoyed banking as a profession right from the onset and because of the passion I had for it, it became a place that I went to be happy. I worked 16 hours a day and I enjoyed every minute of it,” he says.

Many years later, Ovia knew the business inside-out and nurtured his brainchild, Zenith Bank, to rude health. ICT was the next fertile field.

“The way I see it, all are seamlessly interwoven. You can’t do telecommunications without combining information and vice versa. As part of my interwoven passions, it became my immediate desire, and the next level of evolution for me was the establishment of a mobile phone company,” he says.

Ovia was one of the early players in the internet space and established a company called Cyberspace in 1995, when the internet was almost unheard of in Nigeria.

“We were the pioneering set of internet service providers in the country and it was very challenging back then because there were no submarine fiber optic cables to give us the bandwidth and speed we needed to download data. We then had to rely on satellite dishes that would provide this speed to log into any portal out of the country,” he says.

As the private sector fought steadily for its place, the government kept a firm grasp on major sectors, especially telecommunications. Nigerian Telecommunications (NITEL) enjoyed a monopoly.

“It had the density of only about 0.04 percent, which equated to about 250 entities and homes sharing a telephone line. There were hardly 450,000 existing lines for an entire population of about 120 million Nigerians then. Today, we have about three other submarine cables that enable high-speed broadband technology internet services in the country.”

Ovia’s telecommunications company, Visafone, was another testament to his faith in timing and instinct. The Nigerian government, after an apparent communications epiphany, decided to license the Global System for Communications (GSM) services to a few bidders. Ovia didn’t participate in this auction—an opportunity every bidder couldn’t afford to miss back then.

“All my attention was focused on building a strong financial institution at that point, I couldn’t afford to be distracted and the timing was unfortunately not good for me. Failure is an opportunity to learn… You can only succeed when you fail, get up and then run again. I was determined to keep running.”

Ovia’s philosophy on setbacks was useful when a new directive from the Central Bank of Nigeria, on the tenure of bank CEOs, forced him to step down from an organization he had built from scratch.

“I immediately took it in my stride and couldn’t find any reason for resistance… I’m in fact glad that decision was made, because it also opened up tremendous opportunities for me and this allowed me to move on to accomplish new things I wouldn’t have had the time for.”

With this philosophy in mind, Ovia started anew. Along one of the major roads in Victoria Island, Ozumba Mbadiwe, is the waterfront, which used to be refuse dump. A drive along this road saw the genesis of Ovia’s real estate empire.

“I saw an opportunity on this refuse dump and decided to transform it into something else. The result of this foresight is the famous Lagos Civic Centre—a masterpiece event venue on the waterfront. This development immediately opened up other opportunities,” says Ovia.

Lagos, a metropolitan mega-city with a population of around 21 million, scores poorly when it comes to hotel rooms per head. Ovia saw the gap. As the result of a multi million dollar deal, the Lagos Marriott Hotel is set to open in December next year.

“This is one of the ways to create an enabling environment for the future of tourism in Nigeria,” says Ovia.

Philanthropy is equally important to him. He has embarked on the establishment of a free, co-educational high school, James Hope College, in Delta State, the place where he pondered his future as a young man. The school, an 18-month project, launches in September with an initial capacity for 420 students. He is also the founder of Mankind United To Support Total Education (MUSTE), an organization providing scholarships for the underprivileged.

“This will provide an opportunity for our future leaders. It is a mission I’m thrilled to drive, as it is a great investment in the future of my country. The first thing you learn in business is to make profit. However, how you choose to spend the profits is just as important. Philanthropy is important to me as I derive more joy from spending mine this way. You need to give back, reach out to the larger society and less privileged,” he says.

In the past year, Ovia gave $6.3 million to help the rehabilitation of flood victims across Nigeria. He also runs a non-governmental organization for young Nigerians that drives social change through information and communications technologies. Ovia is a father of five and a family man.

“Family is very important and I derive tremendous joy from being with [them]. I’ve always been family-focused. My father had three wives and I have almost a dozen siblings but we’ve always been very close-knit,” he says.

While he is revered by many, Ovia has also been influenced by a few. One of his inspirations is Akintola Williams, the first African to qualify as a chartered accountant, whose firm, Akintola Williams & Co., was founded in 1952. The company merged with two other accounting firms to create Akintola Williams Deloitte, the largest professional services firm in Nigeria today—a position it has held since 2004.

“This 94-year-old man is someone that I have so much respect and gratitude for. He inspired me very greatly, because he’s a man of honor, integrity and an unbelievable level of discipline,” says Ovia.

Ovia learned from many to become the fourth richest man in Nigeria and the 19th richest in Africa. I ask him about his fortune but he becomes reticent.

“Wealth means nothing to me—it’s what you do with it that is truly important. Yes, I am blessed but there is really nothing special about me. I’m just a regular guy who has a hunch for identifying opportunities and taking advantage of them.”

He says that he achieved his success by remaining truthful to every partner and stakeholder.

“Honesty and integrity are key. Always honor contracts. That speaks volumes. It’s very important to be of tremendous integrity. There are really no shortcuts. Those who try to take shortcuts will always fail,” he says.

When it comes to Nigeria and its entrepreneurs, Ovia is fulsome, believing that with improving infrastructure and the privatization of the power sector, the country is a breeding ground for entrepreneurial spirit.

“Nigeria will be a gold mine in the next few years… Every day, international airlines are fully-booked to come to Nigeria and the only reason they do this is because the return on investment here is one of the highest in the world. I’m very proud to be a Nigerian because this country gives… tremendous opportunity to blossom,” he says.

Nigeria is a country that rewards hard work and Ovia says that some foreign investors misunderstand the terrain. The solution, he says, is understanding that while the work is tough, it is very rewarding.

Zenith has seen the fruits of this kind of hard work. This was reflected in the 2012 financial year, as it achieved $634 million profit after tax, according to reports released by the Nigerian Stock Exchange (NSE) a grand feat that not only saw it become the first bank to cross the 100 billion naira mark within a financial year, but also reflected an impressive 106.7% growth on the $303.2 million profit after tax recorded for the 2011 financial year.

Zenith is now Nigeria’s largest bank. It recently listed $850-million worth of shares on the London Stock Exchange at $6.80 a share, to improve its liquidity through Global Depository Receipts (GDR). It has a current market capitalization of around $4 billion, according to the NSE.

In recognition of his accomplishments in the banking sector, Ovia was conferred with the national award of the Commander of the Order of the Niger (CON) in November 2011.

From these achievements, it may seem to many that Ovia has reached his zenith with a sharp mind that once saw value in a refuse dump.

Loading...