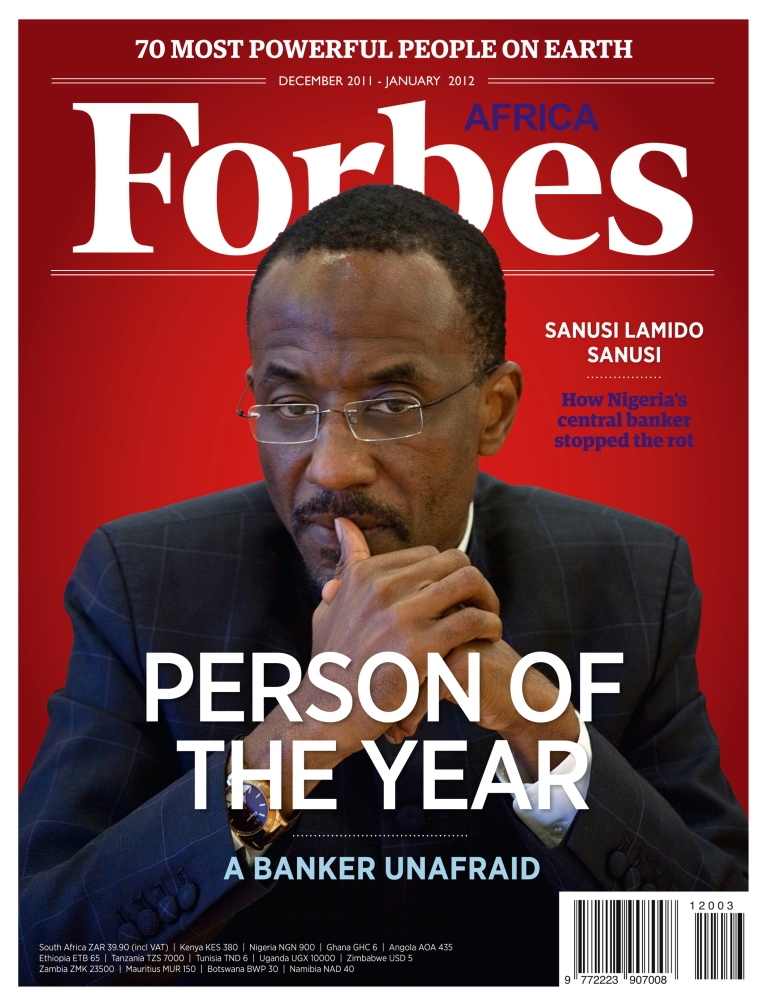

SANUSI LAMIDO SANUSI

Governor of the Central Bank of Nigeria

In a country plagued by corruption, fraud and money laundering, no-one had expected such a radical, and by his own admission, “sudden” and “very risky” move. A mere two months into the job of Nigeria’s Central Bank Governor, Sanusi Lamido Sanusi fired, in one fell swoop, five CEOs of the country’s leading banks for mismanagement and corruption.

In a place where those who end the careers of others get theirs abruptly ended too, Sanusi, as some of his critics retorted at the time, had gone too far; he had overplayed his hand. His answer: “Well they should tell me exactly where I should have stopped. People have stolen money and run banks to the ground. Was I supposed to leave them?”

Considering the fact that he knew some of the executives personally, and the initial five institutions that were affected by his action accounted for a big chunk of the country’s bank deposits—his move was to be a litmus test for the resilience of Nigeria’s financial services industry, to say nothing of his own character and principles. But when further investigations revealed that at least a third of the country’s banks were being toyed with, he was given more reason to put public interest before his and “stand for those who couldn’t stand for themselves”—even if that meant “taking difficult decisions that were painful” to him personally.

Loading...

Sanusi would later tell pan-African television network, CNBC Africa, that although the three weeks he spent arduously contemplating the axing of the bank executives was “the most difficult part of my life”, he was “pleasantly surprised” at the amount of support he subsequently got from the people of Nigeria, across the board and including the country’s politicians, many of whom are known to be weak-willed and dependent on business people to bankroll their lives.

But if politicians and Bretton Woods thought that because they had supported Sanusi, he was in their pockets, they were so wrong. In Sanusi’s book, it soon became apparent, there are no permanent friends.

The legislators discovered this some months ago when Sanusi told a public gathering that 25.4% of the nation’s overhead cost was spent on Parliament, something many surmised as a veiled criticism of the way the country’s budget was allocated. Furious with him for “deliberately inciting” the populace, the lawmakers summoned him to Parliament and after a lot of tongue-lashing asked him to apologize. Sanusi stuck to his guns. He told the politicians: “If I do not believe that I am wrong, I do not apologize.”

A month later Sanusi butted heads, again. This time with the International Monetary Fund (IMF) for a suggestion that Nigeria should devalue its currency. He slated them for advice that was “simply not based on sound economic logic”.

When the FORBES AFRICA team informed Sanusi that he had been short listed for the Person of the Year, we asked him whether, after having stepped on so many toes in such a short space of time, there was ever a time he considered, well… er…taking it easy?

“No, I never did,” he said pointedly, “on the contrary—I sometimes thought I didn’t step on enough toes. I think that part of my responsibility as a Nigerian is to ask what are the things wrong in our society and that need to be changed and what can I do in my position to change it.”

Change has indeed come to Africa’s most populous nation—thanks, in no small measure, to Sanusi among others.

“His quick and firm actions likely prevented a systemic banking crisis,” the IMF notes in its latest report on Nigeria.

“The core function of a central bank is to provide financial system stability, exchange rate stability, and price stability. Therefore, to have been able to provide stability in the last two years when the rest of the global economy has been in turmoil has been the principal achievement,” Sanusi says.

“Everything we’ve done in terms of the recapitalization of the banks, mergers and acquisitions, governance reforms etc are all aimed at financial stability. We’ve been able to do that while achieving stability in the exchange rate and keeping inflation relatively under control. Obviously, we’ve had volatility in interest rates and exchange rates because you can’t have price, exchange rate and interest rate control at the same time. But I think we’ve achieved our core mandate.”

Business confidence has surged and Africa’s third-largest economy is expected to grow above trend, with favorable medium-term prospects. A 7% real GDP growth is relatively high, even though it is below the double-digit levels the country requires if it is to become one of the world’s top 20 economies.

“It’s just an arithmetic fact that at current growth rates we’ll take over from South Africa in terms of share size. But this is a country of 167 million people and growing and 7% growth at the moment does not improve the welfare of the people of Nigeria and we need a higher rate of growth than we have at the moment,” Sanusi says: “The focus should not be on GDP, but GDP per capita, human development indicators and the quality of life of the population. Inclusive growth is the challenge.

Double-digit growth will be a function of the right policies, he says: “We already have 7% growth without power and infrastructure. Growth that has come largely from telecoms, wholesale and retail trade and the good fortune of rainfall for agriculture. It’s a no brainer that if we begin to move, for instance, agriculture production towards global averages we can probably double growth in that sector and build manufacturing by fixing power and infrastructure, moving from 7% to 12 or 13%.”

Born on July 31, 1961, of a public servant father who headed the Nigerian Ministry of Foreign Affairs in the 1960s, Sanusi has BSc and MSc degrees.

Between 1983 and 1985 he taught economics at his alma mater, Ahmadu Bello University, before joining the private sector.

He was the CEO of First Bank when, some day in late February 2009, he received a call from the then Nigerian President, Umaru Yar’Adua.

“We spent about 15 minutes chatting about family,” Sanusi recalls. But it wasn’t until May 8 of the same year that Sanusi got another call, this time the head of state informing him of his wish to make him the Governor of the Central Bank of Nigeria. It came as a big shock to Sanusi, who had never met his president before and thought you had to lobby to get such jobs.

Little did he know that two years on, he would have behind him such accolades as World Central Bank Governor of the Year 2011, Sub-Saharan Central Bank Governor of The Year 2011, African Central Bank Governor of The Year 2010 and People’s Person of The Year 2010.

He is most likely to arrive at the Forbes Africa Person of the Year awards ceremony in Lagos wearing a bow tie, for he refuses to wear a conventional tie. A bow tie, he says, is “cute” and speaks to his “instinctive sense of being different”. What else would you expect from a banker who never runs with the herd.

Loading...