Patrice Motsepe works so hard to preserve his mystique that you’d be forgiven for thinking South Africa’s first black billionaire is a rather reticent man. He is anything but.

An enigma perhaps, but as the FORBES AFRICA team discovered, the mining magnate whose net worth currently stands at $3.3 billion, largely through his company African Rainbow Minerals (ARM), is unafraid to speak his mind.

Motsepe is always inundated with interview requests but rarely accepts them—in the past 10 years he has done only a handful. But these are different times. While the commodities market is experiencing a boom, the industry Motsepe makes almost all his money from, mining, is in a spin. This after a powerful lobby within the country’s ruling party, the African National Congress (ANC), started agitating for nationalization and made it known that they’d like to see this policy being adopted at the party’s elective conference in December 2012.

The loud call—thought to be one of the main contributors to the country’s potentially worsening political risk profile—has been met with an eerie quiet from the country’s captains of industry.

The Chamber of Mines of South Africa, of which Motsepe is an executive member, has not said much beyond “seeking clarity” from the ruling party and, after being told that nationalization was not policy, that the ANC would do research into the desirability and modalities of nationalization. On one or two other occasions Chamber CEO, Bheki Sibiya, merely pointed out investors were now “edgy about investing” in South Africa and that “impacts on international confidence and is not conducive for the growth of the industry”.

Loading...

The industry’s numbness, though, is not altogether surprising. The group at the forefront of the campaign, the ANC Youth League, has become as vociferous as it has grown to be powerful. After all, these are the youngsters that took current South African president Jacob Zuma from the brink of political wilderness to the highest political office in the land. So, for good measure, business is generally reluctant to cross swords with them. Led by their firebrand president Julius Malema, they have become disdainful of everyone and everything—including Zuma and the rest of the ANC’s political leadership.

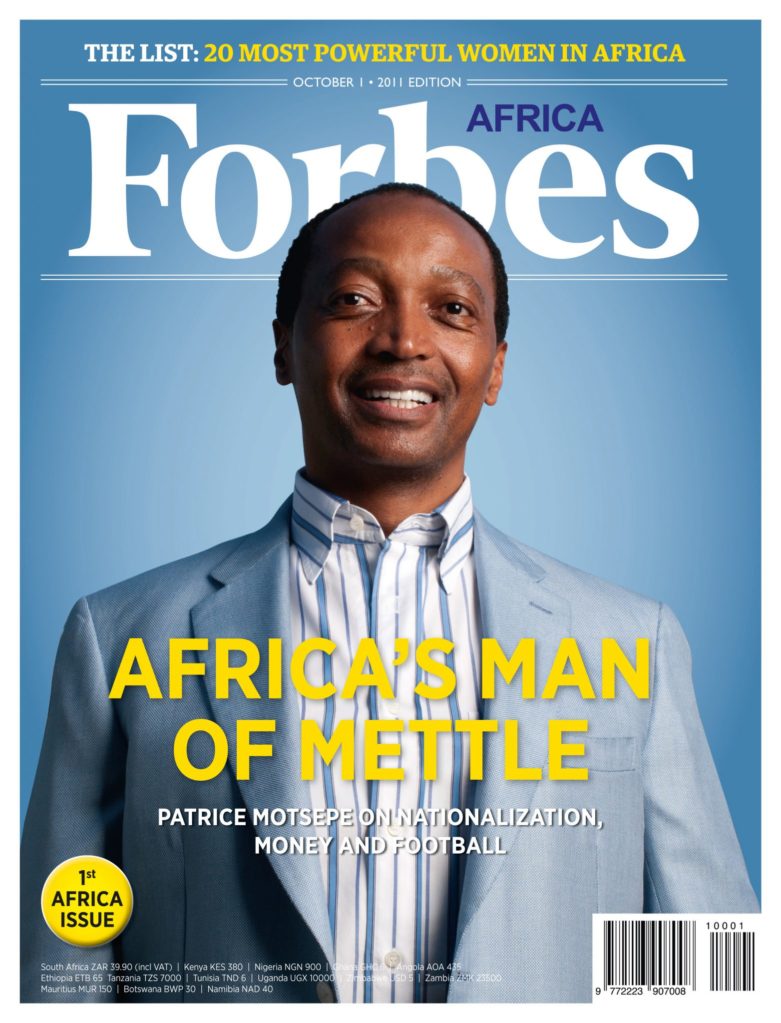

Patrice Motsepe, Johannesburg; 19 August 2011 – Photo by Brett Eloff

For his part, though, Motsepe sounds and looks hardly perturbed. If anything, his demeanor flaunts a level of confidence and optimism, the kind you wouldn’t find from a person who stands to lose handsomely if the cantankerous ANC youth was to have its way.

“I grew up hearing those (nationalization) arguments,” he says, somewhat nonchalantly. “When the debate has taken place, people will understand that there are some countries that followed nationalization but did not help their people. In fact, the conditions of their people worsened.”

“What I take out of the call by the ANC Youth League is the challenge to assess what we are doing as business to help communities. Without a doubt we are not doing enough. ANC people will vote (for or against nationalization at the party’s conference) based on their assessment of business performance. They will vote on the basis of what’s on their own minds, and that which business doesn’t understand.”

How Business Should Deal With The Nationalization Threat

What should business be doing to fend off the calls for nationalization?

Motsepe chides business for “not doing enough” to demonstrate to broader society that it is “a committed partner”. He believes business should be caring about the welfare of its fellow citizens, just like it cares about share growth, competitiveness and the next dividend.

“But you must understand the culture of business in South Africa. For a very long time business was growing and succeeding without regard for the needs of the people,” he explains. “When I sit with business colleagues, I recognize that there are things they don’t understand. These are good people, mind you, but they were not brought up in a culture of having an obligation (to listen to the poor).”

The battle to win over the hearts and minds of the people is as important for business as it is for politicians, Motsepe says. If he were to advise captains of industry he would tell them to start off by reaching out to communities in the same way they go out to the market to convince potential shareholders to invest in their businesses.

“The challenge for us is how do we present an argument to our people that makes them understand that indeed this mixed economy that we have now—where there’s a globally competitive private sector that coexists side by side with a strong developmental state—is what we need.”

A couple of weeks before our interview, Motsepe was in the village of Modikwa in the country’s northern province of Limpopo unveiling a $9 million road that his company had just built to connect the remote villages’ 100,000 inhabitants to the main provincial road, a project that created thousands of jobs during the 14 months of its construction. The country’s deputy president, Kgalema Motlanthe, himself a former secretary general of the National Union of Mineworkers, gave a keynote address while Motsepe had as his special guest nationalization’s foremost campaigner and ANC Youth League president, Malema.

There, Motsepe made the point that his company felt “an obligation” to fund the project despite the reservations of his New York-based shareholders, who felt building roads was a government responsibility.

South Africa’s post-apartheid government has a proud record that it must uphold, Motsepe says. When the ANC took over the running of the country in 1994, the man who would be the nation’s first black state president, Nelson Mandela, took bold steps and settled for sensible, rather than populist, economic policies. Seventeen years on, no less should be expected of leadership, he says. “We should know when we have choice and when we do not. We have to be globally competitive and attractive in whatever we do. And I said this when business met with President Jacob Zuma recently.”

The Continent

For a good few years now, ARM has been a sponsor of the World Economic Forum on Africa, probably the main platform where the continent’s government and business leaders meet to share ideas and discuss possibilities.

It is where Motsepe has seen a maturing of Africa’s leaders, graduating from “a lot of talk, talk, talk” to actually providing the environment for entrepreneurs to flourish.

Patrice Motsepe, Johannesburg; 19 August 2011 – Photo by Brett Eloff

He cites Ghana, Zambia, Mozambique, Nigeria, and Botswana as exemplary countries where legislators are serious about building infrastructure, fighting corruption, crafting new and progressive laws, focusing on education and providing incentives to business. This new attitude has in turn given space to business to come to the party—building hotels and shopping centers, opening or resuscitating mines and getting into a variety of ventures.

“There’s so much good out there. If we continue doing the right things in Africa we can create a very exciting and competitive global market here,” Motsepe says, singling out Nigeria for “doing exceptionally well” and being “ready to challenge South Africa’s dominance in the next five to 10 years”.

Don’t South Africans hate the fact that Nigeria is becoming even more powerful? “I’m an entrepreneur, Motsepe says. “I’ve heard people say South Africans are arrogant, that they act no differently from their colonial masters. That needs to change. It’s in your business interest as an entrepreneur to form meaningful partnerships. That’s how you do well for your shareholders.” As a matter of fact, Motsepe is looking at Nigeria: “We have a private equity fund that’s got money in it.”

Even prodigal Zimbabwe is on his radar screen. He says it’s full of promise. The reason ARM is at present withholding hundreds of millions of dollars in investment into the country is because of “some remaining concerns among shareholders”. Motsepe is “confident” the one-time breadbasket of southern Africa’s unity government won’t waste more time and will get on with the job of providing “the necessary economic, legislative, fiscal, legal and tax changes that’ll result in billions of dollars going there”.

“I have confidence in mining. I see exciting opportunities in it. Infrastructure in the continent is going to be exciting. I’m also looking at passive investments in energy and ICT.”

How do the continent’s infamous ills—among them corruption and political pressure—affect his investment decisions?

“If its pressure like you are finding in South Africa, about what are you doing for the poor and the marginalized, about job creation, I welcome that. I actually encourage it. But if it’s about things improper, unethical abuse of power—that’s unwelcome.”

“When there’s suggestion of bribes or some other kind of corruption we walk away. I have done so in the past and will do so in future. There’s no business in the world that warrants corrupt, improper behavior. It’s just not worth it.”

Reigniting Africa’s Entrepreneurial Spirit

African entrepreneurs have a lot to learn from Indians in terms of “entrepreneurial spirit” and “doing things that are world-class but at significantly lower costs”, Motsepe says, while China can teach the continent a thing or two about “work ethic, competitiveness and modernizing”, and Brazil has good examples of public-private partnerships.

But Africa is not short of its sources of inspiration, or even role models for that matter, Motsepe says.

Just like America gave its people a Bill Gates and a Warren Buffet, Africa has a Mo Ibrahim and an Aliko Dangote—all of them entrepreneurs whose “huge commitment to the communities they come from” is something to be emulated, for they “realize that their success depends on the improvement of the standard of living of their people”.

Mo Ibrahim, the IT billionaire of Sudanese origin, is a philanthropist who, through his foundation supports numerous initiatives that strengthen good governance and which promote exemplary leadership across Africa. He is the founder of Celtel International, a company that now operates in 15 African countries. In 2005 he sold Celtel to MTC Kuwait for $3.4 billion.

Aliko Dangote, whose net worth currently stands at $13.8 billion, is not only the continent’s richest individual but also the 51st richest billionaire in the world. He has interests in oil, gas, sugar, flour milling, salt processing, cement manufacturing, textiles, real estate and cement. He is the continent’s biggest cement maker, with plans under way to construct plants and build cement terminals in Zambia, Tanzania, the Democratic Republic of Congo, Ethiopia, Sierra Leone, Ivory Coast and Liberia, among other countries.

Entrepreneurs like Ibrahim and Dangote also help debunk the myth that the only way Africans get rich is through corruption and other illicit means, Motsepe says.

“But the biggest mistake we make in South Africa, for instance, is to think that we had no entrepreneurs before democracy.”

He wants the history of entrepreneurs in South Africa reconstructed and re-written.

“We had people like Dr Sam Motsuenyane, Richard Maponya, Habakuk Shikwane—who in many ways defied apartheid laws that restricted them and set up successful businesses.”

“If playing fields were leveled at the time, it would have been different. It was difficult for those entrepreneurs to even get a general dealer license.”

Motsepe’s Rise And Rise

Motsepe’s own father, Augustine—the man he says had the most influence on him—was in the general dealership business.

“I was six-years-old when I started standing behind a counter helping my father in his shop, and saw him steadily building his business, adding a bottle store, and growing,” he recalls.

Motsepe started his primary schooling in Orlando, the Soweto township where he was born. He was later sent to a Catholic mission school. Upon finishing high school, and “with positive pressure and encouragement” from his father, he went to Swaziland University where he would later graduate with a BA degree. After graduation it was back to Johannesburg where he enrolled and passed his LLB.

Articles followed, and later he joined reputable Johannesburg law firm Bowman Gilfillan, specializing in mining and becoming their first black partner.

A few years before South Africa’s watershed moment—the country’s first democratic elections of 1994—the young lawyer approached mining giants, Anglo American, offering to take over some of the company’s loss-making, low-producing marginal mines.

“I said: ‘Go and look at some of your deposits. You will see that some will not suit your long life, high-grade asset requirements. I can go in there with people who have history and a track record in small scale mining.’”

“Everyone thought I was crazy”, says Motsepe.“The mineworkers’ union condemned me for wanting to take over old, useless mines.”

He persisted, and five years later Anglo gave him what he wanted. He started off by forming a contract mining venture, Future Mining, providing various services to Anglo American’s Vaal Reefs gold mine.

Three years later Future Mining would become ARM Gold. Another few years on, Motsepe would purchase a number of other marginal shafts.

An aggressive growth path would follow, underpinned by a series of bigger transactions and mergers.

And the rest, as they say, is history. Suffice to say, ARM’s annual profits jumped by 83% for the financial year that ended on the June 30, 2011, following the surge of headline earnings by 94% to R3.3 billion ($471 million).

ARM (share price $26.75) is in fact “under-valued”, according to Peter Major, who is spearheading Cadiz Corporate Solutions’ mining and resources division. He says that with such a “healthy balance sheet and not much debt”, Motsepe’s “well-managed” company is “a good buy”.

The Role Of SA’s Bee Laws In Motsepe’s Rise And Rise

“I have never had a government tender,” Motsepe says with glee.

“Of course, if there was no democracy in South Africa, opportunities that opened wouldn’t have opened. But if you look at every transaction we did, there was no empowerment.”

So what has made ARM so successful?

The company’s “lean, mean management structure” is the first reason Motsepe gives.

A bit of innovation and creativity also played a part, he says: “When Anglo closed down mines and retrenched 8,000 workers, we went to the National Union of Mineworkers and said we’d take 6,000 people, pay them less, but you’ll share in the profits. The workers agreed. If they didn’t buy in we would not be here.”

But what did ARM do right, that which Anglo could not do?

“Anglo had high grade mines. Issues of efficiency are a bit of a luxury when you come from a culture of abundance”, he replies, “running marginal mines is a humbling job—it’s do or die.”

Going to bed, instead of competing with rival Harmony was also one of the best things ARM did, Motsepe explains: “When Anglo was diversifying and didn’t want to be just in South Africa, (Harmony CEO) Bernard Swanepoel would better my offer whenever I made a bid. He was listed and therefore had access to finance. I wasn’t listed and I got finance expensively”. When both companies got an opportunity to bid for Freegold, Motsepe says he went to Swanepoel. “I said: ‘The only person who benefits by us paying more, is Anglo.’ We then merged ARM Gold with Harmony, went to Anglo and got a good deal.”

Key To Motsepe’s Success… And His Major Weakness

The key to his success is the question Motsepe says he always asks himself: “Can you hold your own against the best in the world?”

He also credits his parents: “My parents insisted we should always be seen as people who are respectful, never forget where we come from and more importantly, that we are part of the challenges that face our people. I wouldn’t be here if it wasn’t for the way they brought me up.”

All the businesses’ management teams comprise of the best people his money can buy. “My policy is hire the best and pay them well.”

No wonder he honors all the invitations to gatherings of the world’s top 1,000 CEOs and sits on several boards, including the JP Morgan Advisory Council.

But then who wouldn’t want to court the man CEOs of the top 100 companies in South Africa voted South Africa’s Business Leader of the Year in 2002, the same year he traveled to Monaco to receive the Ernst & Young Best Entrepreneur of the Year Award?

ARM, of which Motsepe is executive chairman, sits pretty. Now a global company with a presence in several African countries, it boasts a portfolio that includes interests in gold, platinum, nickel, chrome, iron, manganese and coal.

Even though the recession devoured some of the company’s shares, wiping out $319.5 million in 2009 and $236 million in 2010, Motsepe can still afford his biggest indulgence: soccer.

“I’m passionate about football,” says the owner of Mamelodi Sundowns—one of the four biggest teams in South Africa’s Premier League and one that reportedly pays the best salaries in the business.

“We went mainly into soccer not to make money but as means of giving back. Of course we never thought we would lose so much money. But it’s important for people to know they can relate to you, that you are not an arrogant, wealthy, aloof, uninvolved person.”

At what cost? “Millions of rand a year,” he says.

And how does he feel about pouring that much into what appears to be a bottomless pit? “It’s OK”, he says, curling his lip and shrugging his shoulders. “People must see you as someone who is fallible, who also makes mistakes. I’m a sinner. I fumble. People must see me as one of them. The things that worry them must worry me. Other than being miserable watching Sundowns, I have very little else. I have one home and not even one holiday home. I fly around the world a lot, all the time, and I spend a lot of money doing it. I was resisting it, but it’s going to be imperative to get a private jet. It’s unavoidable. The problem is those things are expensive.”

One day, when he is no longer a permanent feature of business life, how would Patrice Motsepe like to be remembered? The way you would remember his heroes Nelson Mandela and Oliver Tambo, he says.

“Great Africans are not judged by how much money they have—but what they’ve done for their people.”

Loading...