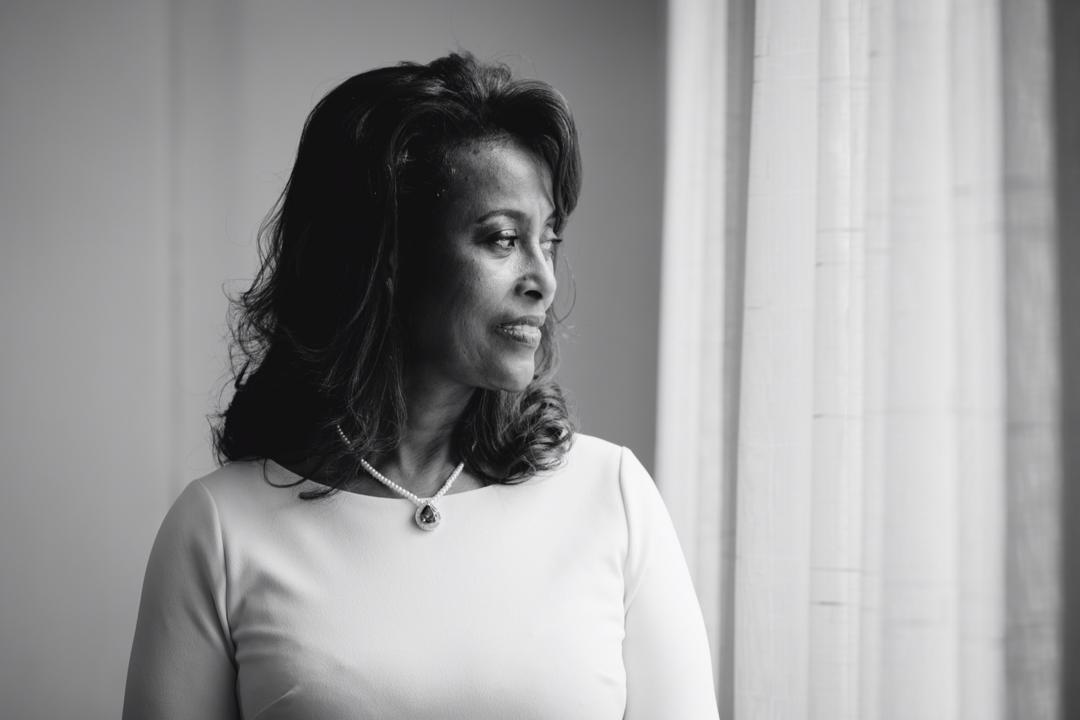

Meaza Ashenafi is the Founding Board Chair of Enat Bank, Ethiopia’s first women-focused bank, and the former Chief Justice of Ethiopia’s Supreme Court. A lawyer by training, she is no stranger to breaking barriers. Her pioneering efforts have been instrumental in providing women with financial access and opportunities, and amplifying the contributions of women to society.

Q. As a prominent advocate for gender equality and women’s rights in Ethiopia, how do you think African countries can increase women’s access to finance and ensure their economies work for women?

A. Given the enterprising spirit of African women and the challenge they face in accessing finance, national governments and policymakers must design and implement inclusive policies that make structural and sustained changes to ensure women’s meaningful participation in the economy. While African governments have taken some measures to address financial inclusion for women and other underserved communities, the existing gap demands greater effort.

Innovative financial institutions, like the one we established in Ethiopia, Enat Bank, can inspire mainstream financial institutions to meet the unmet financial needs of women. Banks established to cater to the needs of women are rare, not just in Africa, but globally. However, following inclusive government policy directives or under the guidance of visionary leaders, mainstream banks can become powerful vehicles for women’s economic empowerment. The Ugandan Development Bank is reported to be one such example.

Q. As a legal expert, can you share examples of how you’ve leveraged the law to advance financial opportunities for women in Ethiopia? Are there any existing legal barriers that prevent women from participating in and influencing the economy?

Loading...

A. The law serves as a vital tool for promoting the economic, social, and political rights of women. I have been fortunate to work towards women’s rights and gender equality from various perspectives.

The 1994 Ethiopian Constitution includes affirmative action in both public and private sectors to rectify past and present injustices. Such legal guarantees have enabled advocacy groups like the Ethiopian Women Lawyers Association (EWLA) to demand law enforcement through advocacy and litigation.

Recognizing the challenges in fully realizing women’s rights, we initiated the establishment of financial institutions to support and facilitate women’s economic power. This proved to be an exemplary model for harnessing women’s potential incrementally. Yet, despite legal reforms, discriminatory laws in many African countries still affect women’s economic rights. Affirmative action is needed for equality.

Q. What are some of the biggest challenges you have encountered in promoting access to finance and women’s financial inclusion? How have you addressed these obstacles?

A. Together with businesswomen and professionals, we founded a bank for women’s financial needs. Initially, our vision, to go beyond microfinance and focus on universal service with an emphasis on women, was challenging to articulate. Over time, our proposition gained momentum and our vision was realized.

We succeeded in establishing a bank that has opened 200 branches across the country over a decade. As the first female Board Chair of a commercial bank with mostly female shareholders, board members, and staff, I inspired other banks to recognize women’s market potential and launch targeted products. Our bank’s women’s financial solutions department innovatively provides both financial and non-financial services to more women. Despite challenges, we strive to maintain profitability and satisfy the growing number of women needing loans.

Q. Women business owners in sub-Saharan Africa receive only 15% of loans issued to small and medium-sized businesses. What advice would you give policymakers and young women entrepreneurs to address this gap?

A. The gender gap data is alarming across legal equality, access to finance, and other social and economic areas. However, we should also recognize progress in girls’ education, women’s employment, and their political representation.

Unfortunately, during conflict and political instability, these gains can be quickly eroded. Women lose their livelihoods, are subjected to sexual violence, and become exposed to harmful traditional practices once again. It’s disheartening that the financial gap facing African women is estimated at US$42 billion and that women receive only 15% of available loans, considering that a quarter of African women are engaged in some form of business activity.

Bold and consistent action is required to address this gap. Women’s economic justice is a key element and driver of the Sustainable Development Goals. My advice to businesswomen is to champion their interests, be confident, know their rights, believe in their success, and share their unique stories.

Q. What has motivated your work and engagement around women’s access to finance and what do you see as the most critical steps needed to further enhance women’s economic power in Ethiopia and across Africa?

A. My work as an activist, an international civil servant, the founder of a women-focused financial institution, and the first female Chief Justice, is consistently driven by the promotion of the rule of law, equality, and human rights.

My journey has taught me that women’s activism is crucial to initiating and catalyzing legal and policy reform. We must occupy leadership positions and be in the decision-making rooms to achieve what we want, and once we’re there, we must deliver for women. Building institutions, especially innovative startups by women, should be supported through finance and training. Those with resources should invest in this area to reap the rewards with a multiplier effect on families and communities.

African governments and national and international financial institutions can go beyond token policy or resource allocation gestures. National and international entities for women’s empowerment need to be more visible, forceful and inspiring.

About This Series

This article is part of a five-part series celebrating trailblazing African women who are strengthening the economic power of women across the continent. At the root of this power lies the need to build inclusive systems designed to benefit all. This means moving beyond just providing financial resources to women, and building the systems that empower women with the financial literacy and autonomy they need to make their own financial decisions.

This series will feature African women who are leading the charge in core areas of development, including financial inclusion, digital public infrastructure, women’s health, care and agriculture development, all of which are essential to advancing women’s economic power in Africa.

Loading...