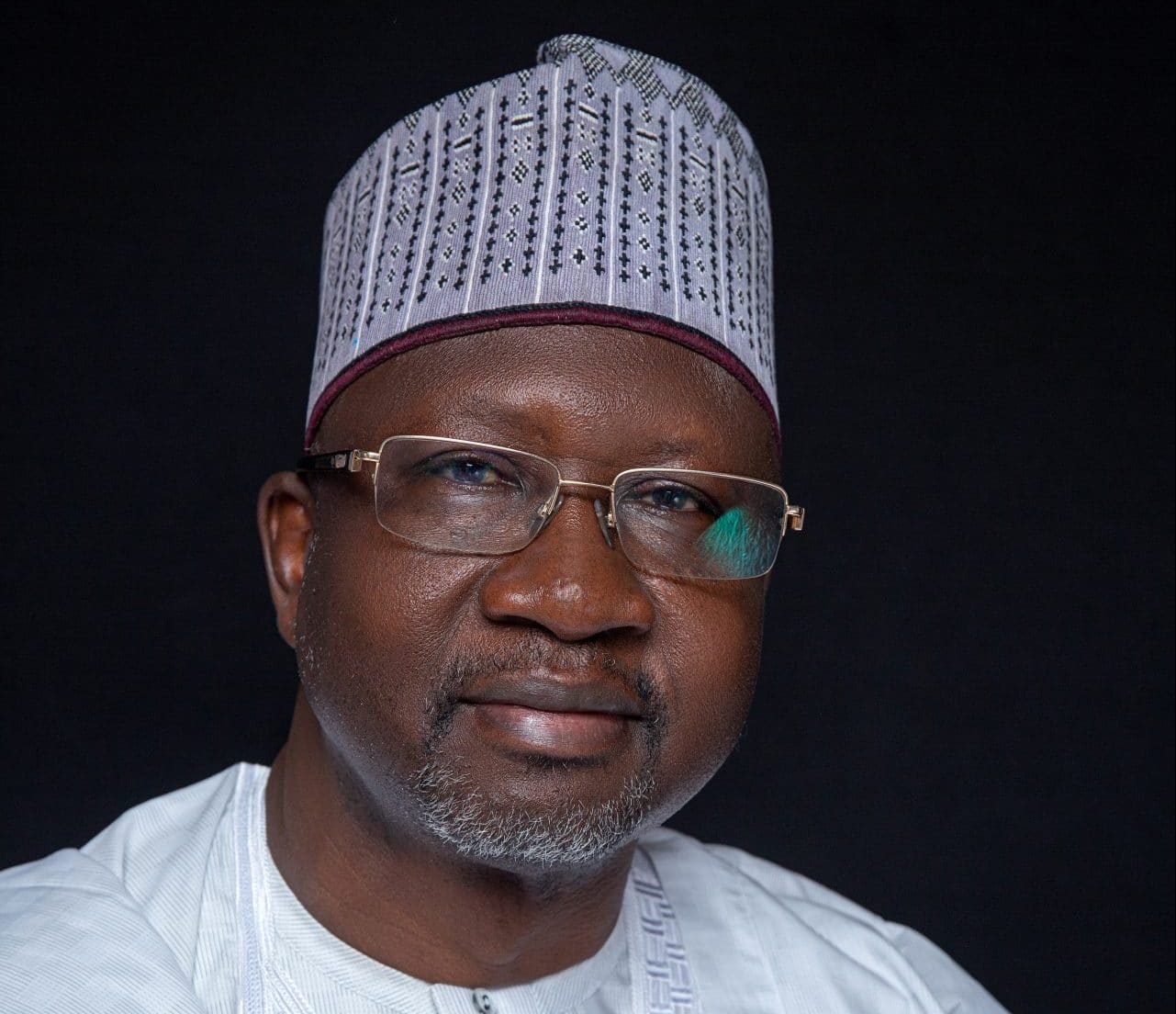

True Nigerian Experience Interview with Engr. Lamu Audu

1. During the 2013 Power Sector Privatisation, Mainstream Energy Solutions Limited (MESL) acquired Kainji and Jebba Hydro Power Plants. 6 years down the line, how well have you fared on this project?

It has been a very interesting journey for us since we took over the operation and management of the Kainji and Jebba Hydropower Plants (“HPPs”) through a concession agreement with the Federal Government of Nigeria (“FGN”) in

November 2013.

It was incredibly challenging at the initial stages, especially at Kainji where the available capacity was at zero (0) megawatts (MW). None of the eight (8) generating units with a total installed capacity of 760 MW, was operational in November 2013. However, in the case at the Jebba HPP which has total installed capacity of 578.4 MW, five (5) of the six (6) generating units were in operation, with a total available capacity of 460 MW.

Loading...

Today, we are proud to have increased the total available capacity of both plants to 922 MW, with Kainji being the major success story as it now has four (4) operating units at an available capacity of 440MW while Jebba contributes 482MW to the National Grid. This has translated to a remarkable improvement in MESL’s power generation from 2,715 gigawatt hours (GWh) in 2013 to 5,277 GWh in 2018, accounting for an average of 25% of Nigeria’s power generation.

I would say that we have done very well in optimising power generation in Nigeria and delivering on the mandate of the FGN following the decision to privatise the Nigerian Electricity Supply Industry (“NESI”), six (6) years ago. What we have achieved so far is vivid proof that privatisation works as it has created an avenue for private sector investments into the industry, for the benefit of the economy.

2. In 2018 financial year, MESL generated about 60 Billion Naira in revenue up from 3.7 Billion in 2013 financial year. How did you achieve this?

A whole lot of factors have contributed to the company’s growth over the last six (6) years. With a visionary and astute board of directors and committed and diligent management team, the company has put in place several programmes focused on technical and human resource capacity development to galvanise the operation and management of both power plants.

In the area of technical capacity building, MESL has a robust Capacity Recovery and Expansion Programme which we have pursued vigorously by focusing on restoring the capacity at Kainji to guarantee year-round power generation of at least 750 MW on average. The company also invested heavily in technology and state-of-the-art equipment to optimise operation and maintenance at both plants, such as the satellite-based technology, called the Inflow Forecasting System and Operational Tool Software (IFS/OPT). This aids flood management and projections of the flow of water into the Kainji reservoir and guides our operations to maximise power generation at the plants.

As you are aware, no company can thrive without the help of skilled and committed personnel, as such, we deemed it our utmost priority to focus on building a strong culture within the organisation. In the words of the renowned Peter Drucker “Culture eats strategy for breakfast”, so it was important that we paid close attention to the development of the “MESL Culture”.

The Board of Directors, therefore, made a strategic decision to consolidate the management of both plants, which were under two (2) managements prior to the concession. Management, under my leadership was also given the mandate to institutionalise a strong work ethic amongst staff, establish a competitive staff welfare package, robust performance management framework and most importantly, conduct a Change Management Programme for the employees that had previously been engaged by the erstwhile Power Holding Company of Nigeria (“PHCN”).

We needed the employees, myself included, to start thinking of power generation from a profit-driven perspective. I must confess that this took some time, but we are proud of our achievements thus far in turning the plants around significantly and positioning for greater successes in the future.

Our focus on staff welfare has been integral to the growth of this company as employees now have a sense of ownership. Indeed, MESL has put in place a share trust scheme where every employee becomes a beneficial owner of the company upon assumption of duty.

I would therefore say that the effectiveness of these programmes has driven productivity amongst staff and aided the growth of the business to where it is today.

3.Your profitability also took an upward trend from a 1 Billion Naira loss position in 2013 to 26.3 Billion profit after tax in 2018. Again, how did you do this?

A major turning point was the total repayment of the company’s acquisition loan of $170 million which enabled the company to optimise its profitability as a business.

The growth of the business from 2013 has been phenomenal, but this has not been without its challenges. We know that we could perform even better if key issues across the value chain of the NESI are addressed. For example, we have major challenges with the collection of receivables, as we are presently being paid a meagre 18-20% of our invoices, due to collection losses at the distribution end of the value chain.

“In the words of Peter Drucker, Culture eats strategy for breakfast, so it was important that we paid close attention to the development of the “MESL Culture”.

This means that as at September 2019, the company is being owed over 100 billion Naira in receivables. We are also inundated by ramp down requests due to grid instability, which also leads to revenue losses. We have lost about 17 billion Naira from 2016 till date because of this.

MESL has been able to position itself as a performance leader within the industry by proffering innovative and practical solutions to boost its capacity for the benefit of the country. It is our hope that appropriate policies are put in place by the relevant authorities to provide an enabling environment for the NESI to sustain itself through inflow of investments to finance the industry’s infrastructure requirements; coupled with a cost-reflective tariff on electricity, we believe these losses could be significantly reduced, and eliminated over time.

4. Having successfully turned around Kainji and Jebba Hydro Power Plants, are there aspirations to venture into Distribution or consolidation of your competitors?

Our primary priority as the largest hydropower generation company is to support the stability of the National Grid, increase capacity and contribute to national development by generating power in a safe and reliable manner.

In the short- to medium-term, our focus is on the recovery and expansion of capacity at both Kainji and Jebba. We have indeed commenced the rehabilitation of Unit 1G7 at Kainji which will add 80 MW to the National Grid in 2020 and we are at the closing stages of negotiations for the rehabilitation of Unit 2G6 at Jebba which upon completion will add 96.4 MW to the Grid. In line with the expansion programme, MESL will also install additional generation units with a combined 200 MW at Kainji HPP, to expand the installed capacity of Kainji to 960 MW.

As a member of the West African Power Pool (WAPP) under the auspices of the Economic Community of West African States (ECOWAS), MESL is also strategically positioned to support the West African regional electricity market, hence, the need to focus squarely on the expansion of capacity to achieve our mission and vision.

We are also looking to extend our coverage beyond Nigeria through strategic investments in hydro and other renewable power generation projects (brownfield and greenfield) in West Africa. Investments in solar power generation would help complement the management of our HPPs and provide off-grid solutions to support the growth and development of the Nigerian economy.

In collaboration with the Niger State Government, MESL has also committed capital towards the establishment of the Amfani Industrial Park and Free Trade Zone, strategically located at the east of the Kainji Lake and adjacent to Kainji HPP, to attract investments into the country. This development will provide an avenue for local and international companies to set up their businesses and have access to power, water, transportation networks and other ancillary utilities.

Of course, MESL seeks to make strategic Investments to support the value chain of the NESI and has recently invested in certain distribution assets, as we aim to contribute to the growth and development of Nigeria’s economy by aiding the supply of stable and safe electricity for Nigerians to power their homes and businesses.

Loading...